World Economic Outlook in Spring 2025 Growth Amid Global Turbulence

Rising tariffs are projected to hinder global economic growth and trade in 2025 and 2026. Emerging economies are expected to continue driving global growth, while advanced economies gain support from monetary easing policies. Trade policy developments are the primary downside risk to the economic forecast.

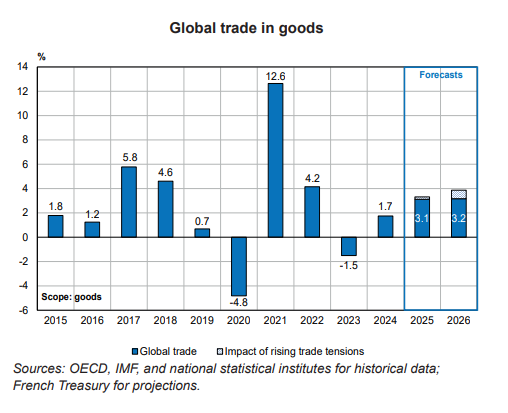

The international scenario, set on 21 February, assumes that the United States will double its existing tariffs on imports from the European Union, China, Canada and Mexico from the 2nd quarter of 2025 onwards. Equivalent countermeasures by these trading partners are also assumed to take effect at the same time. The ensuing turbulence is expected to reduce global GDP growth by 0.1 percentage points (pp) in 2025 and by 0.2 pp in 2026. Similarly, world trade is projected to shrink by 0.2 pp in 2025 and by 0.7 pp the following year.

In line with these assumptions, and provided uncertainties around US economic and trade policies resolve quickly, the global economy should still perform fairly robustly, though somewhat weaker than predicted in September 2024. Global GDP is projected to grow at a steady 3.2% in both 2025 and 2026, roughly in line with 2024, and only marginally below the average pace recorded during the 2010s.

Among advanced economies, economic prospects diverge. Growth is expected to remain solid in the United States – if financial stability persists and investment is not excessively dampened by trade policy uncertainties – and in Spain. Germany, however, faces sluggish prospects, weighed down by delays in the emergence of the recently unveiled investment plans’ effects (announced after the forecast cut-off date), while Italy and the United Kingdom are likely to fall in the middle. These differences reflect differing exposure to tariff hikes and varying growth momentum for 2025, established at the end of 2024. By 2026, these disparities are expected to narrow somewhat.

In the major emerging economies, namely China, India, Brazil and Turkey, economic activity is expected to slow down in 2025. China’s performance is expected to be particularly hampered by enduring structural imbalances. For 2026, the trajectory for emerging economies is expected to be closely tied to the course of monetary policy.

Paradoxically, despite tightening trade policies, global trade volumes are set to pick up speed in 2025 and 2026 after two years of subdued momentum. However, this recovery should be partial and notably weaker than anticipated in the previous September forecast (see Chart). Global trade is expected to continue to be driven by emerging economies, and as a result France should experience comparatively modest demand growth.

These forecasts come with substantial risks – primarily emanating from uncertain global trade policy developments: recent tariff announcements by the US administration amplify downside risk significantly with regard to the assumptions adopted.