World Economic Outlook in Autumn 2024: Monetary Easing and Geopolitical Tensions

DG Trésor predicts that global growth will reach 3.2% in 2024 and 3.4% in 2025. Increasing activity reflects the impact of monetary easing and the rebound in trade. Global activity is projected to be driven primarily by emerging economies despite the slowdown in China. In advanced countries, growth is envisaged to remain strong in the United States and more moderate in the euro area. Geopolitical risks are the main risk to the scenario.

Global growth is expected to reach 3.2% in 2024, a similar rate to 2023, before increasing to 3.4% in 2025. This outlook is a slight improvement on forecasts released in spring 2024. In 2025, global activity is anticipated to grow at the same pace as in the second half of the 2010s, supported by monetary policy easing and strong performances in emerging countries.

Growth is forecast to remain uneven across advanced economies. In 2024, activity is expected to be particularly robust in the United States and Spain, more moderate in Italy and the United Kingdom and flat in Germany. These advanced economies are experiencing different levels of growth due to disparities in consumption patterns and export performance. Growth rates are expected to converge in 2025, with an acceleration of activity in the euro area and a slight slowdown in the United States, primarily due to a weakening of household consumption.

Although still strong, activity in the major emerging economies – China, India, Brazil and Turkey – is projected to slow compared with 2023, particularly in China where structural imbalances are likely to continue to weigh on activity.

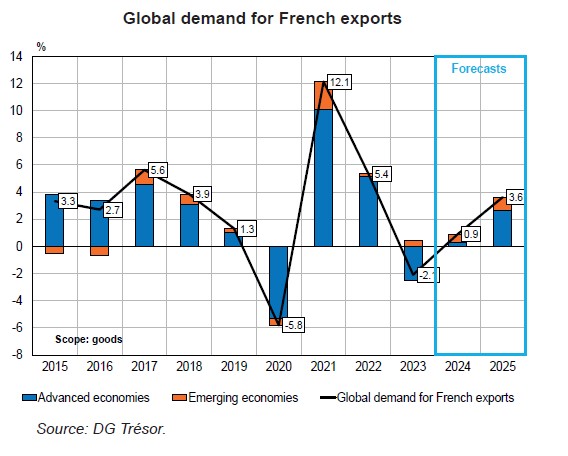

Following a contraction in 2023, global trade is anticipated to recover in 2024 and accelerate in 2025. Global trade is expected to be driven primarily by emerging economies and the United States, resulting in slower growth in global demand for French exports (see Chart).

Global activity could nonetheless be impacted by an escalation of geopolitical tensions, which are the main risks surrounding this scenario.