World Economic Outlook in Spring 2024 Moderate and Uneven Growth

DG Trésor projects that the global economy will expand by 3.1% in 2024 and 3.2% in 2025. This growth rate is slightly higher than expectations from the summer but remains below the pre-pandemic average, underscoring the effects of monetary tightening and geopolitical uncertainties. Growth in advanced economies is expected to be moderate, with significant disparities among countries. Meanwhile, emerging markets should experience robust growth, notwithstanding a slowdown in China.

Global growth is projected at 3.1% in 2024, mirroring the pace set in 2023, with a slight uptick expected in 2025 to 3.2%. This outlook marks a modest improvement over previous forecasts from autumn 2023. Despite easing production constraints and a confirmed inflationary pullback, the global economy remains shackled by the lingering effects of monetary tightening and geopolitical uncertainties. The global economy’s growth trajectory, therefore, slightly lags behind the late 2010s average.

Growth in advanced economies is anticipated to remain subdued, with significant disparities among countries. In 2024, economic activity is expected to be robust in the United States and Spain but sluggish in other major advanced economies like the United Kingdom and Germany. By 2025, growth rates are anticipated to converge, driven by an acceleration in the euro area and a slowdown in the United States, assuming a gradual return of the savings rate to its historical average.

Major emerging economies like India, Turkey and Brazil should see a slowdown in 2024, followed by a rebound in 2025. China’s economy is projected to continue slowing, hampered by its failure to pivot its growth model towards domestic demand.

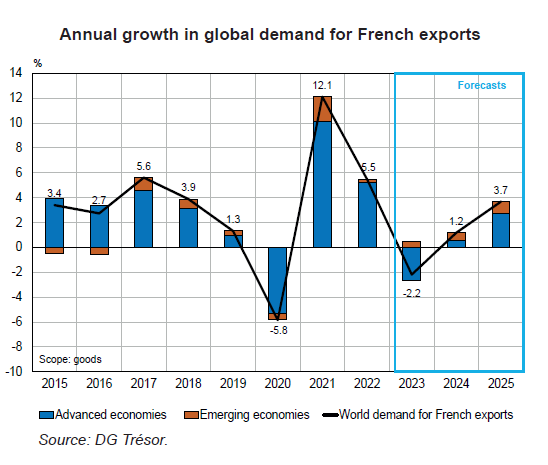

After a decline in 2023, global trade is expected to recover in 2024 and 2025. However, the global demand for French exports is predicted to be less robust than international trade. This reflects the more sluggish activity in the euro area, which is expected to rebound modestly in 2024, before accelerating in 2025 (see Chart on this page).

Geopolitical uncertainties, the timing and magnitude of key rate cuts, and shifts in consumer behaviour emerge as the primary risks surrounding this scenario.