How Dependent Are Emerging Market Economies on China's Growth?

Emerging economies, especially Asian countries and commodity exporters, are the most vulnerable to the structural slowdown in Chinese growth, due to their high degree of trade and financial dependence on China (loans, FDI). They are expected to be affected by falling Chinese demand and the resulting impact on commodity prices, as well as by gradual, ongoing cuts to Chinese financing.

China is now the top export market for many emerging countries, as its average share of exports from these economies rose from 4% in 2002 to 12% in 2022. Additionally, the growth of outbound Chinese tourism has created new forms of dependence, especially for certain Asian countries.

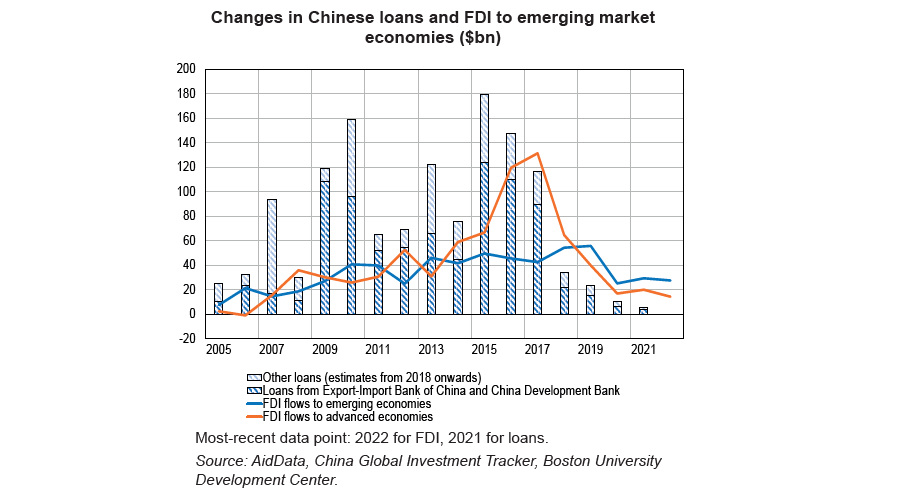

Emerging economies are also financially dependent on China through commercial and sovereign loans. The main recipient sectors (energy, mining and transport) and regions (Asia and Africa for almost 60% of the loans) are in line with China’s strategic priorities, particularly in terms of its supply needs. China’s total outward foreign direct investment (FDI) flows remain low in relation to loans, but Chinese FDI accounts for a significant share of the FDI stock of several countries (Pakistan, Angola, South Africa and Thailand).

China’s slower medium-term growth – which the IMF has projected will fall to 4% over the next few years, down from 8% in the 2010s – will affect emerging economies through two primary channels. On the trade side, slower Chinese growth will result in (i) a decline in domestic demand and imports, and (ii) price and volume effects on commodities. On the finance side, China’s slowdown will play a role in the continued push, which began in 2015, to reduce the flow of its financing (loans and FDI) to emerging economies (see Chart), and in the country’s geographic and sectoral refocusing, as already reflected in the shift in the official stance regarding the Belt and Road Initiative (BRI). Asian countries and commodity-exporting countries are expected to be the most vulnerable to China’s structural slowdown due to their close trade ties with Beijing.