What Factors Could Drive the Reorganisation of Global Value Chains?

While recent crises have been interpreted as signalling the end of globalisation, trade continues to grow and goods are travelling as far as before. Globalisation is, however, taking on a new form: the composition and geography of trade have changed. These changes are likely to intensify owing to companies’ strategies to secure their supply chains, climate change, various government policies and geopolitical tensions.

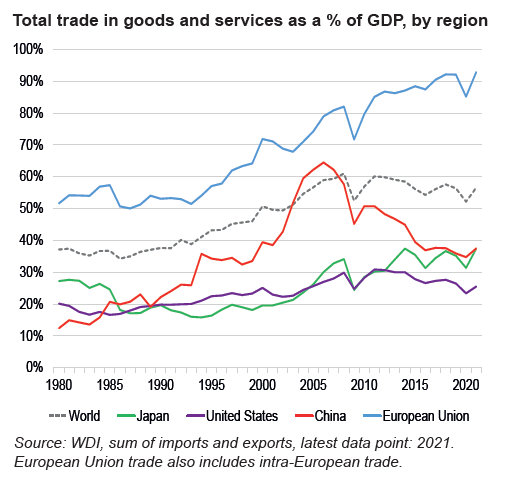

After an exceptional expansion in trade in the 1990s and 2000s, globalisation experienced a slowdown between the financial crisis of 2008 and the COVID-19 pandemic, largely due to the rebalancing of China’s economic growth (see Chart).

The pandemic led to tensions, or even shortages, in certain value chains, revealing supply vulnerabilities in some countries. These disruptions raise the question of how resilient the global production organisation is and if globalisation is built to last. After the shock from the pandemic in 2020, the scale of global trade has exceeded its 2019 level, and the distance travelled by goods is as large as before.

However, the structure of trade has evolved. Exports of goods returned to their pre-pandemic level by December 2020, compared to September 2021 for services. The quick recovery in trade particularly benefitted China, which increased its trade surplus due to its exports.

Changes in the organisation of value chains in the years to come will depend on several factors. Geopolitical tensions and Russia’s invasion of Ukraine have led to trade diversion, which could increase in the context of new sanctions and businesses seeking out more secure ways to conduct trade. Climate change could affect certain production lines, particularly due to a decrease in agricultural yields and the relocation of agricultural production. Governments could encourage or even require businesses to adjust their value chains to reinforce their resilience and sustainability, or respond with protectionist measures.

Owing to these different factors, some particularly concentrated value chains are showing initial signs of diversification. Manufacturers of semiconductors, which have mostly been based in Korea and Taiwan up to now, have announced large-scale investments in production capacity in Japan, the United States and Europe.