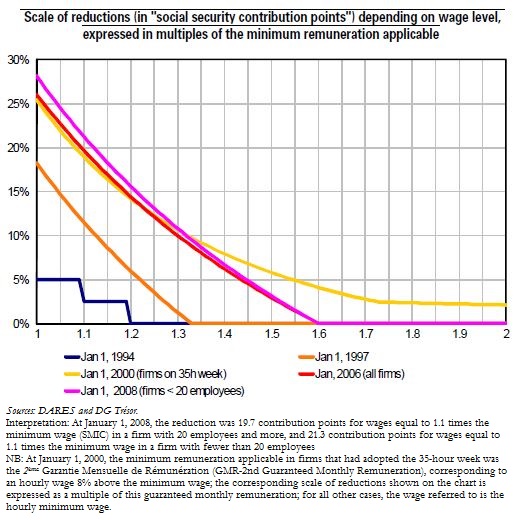

Trésor-Economics No. 97 - Reduced rate employers' social security contributions on low wages in France, 1993-2009

Reduced rate employers' social security contributions for low-wage workers, first introduced in 1993 and progressively extended since then, are a key component of employment policy in France. Their gross cost to public finances amounted €22.2 billion in 2009 (not including revenues from their positive impact on employment and the resulting lower spending on unemployment benefits). This paper summarises the findings of studies on this scheme and updates the work of Boissinot et al.

According to existing studies, this policy has a powerful impact on job creation although its precise extent is controversial. It is highly effective in terms of cost per job created, in present French labour market conditions.

Its effects on wages are more ambiguous: falling unemployment and the share-out of the surplus between employee and employer can lead to a rise in negotiated wages; conversely, the progressive nature of contribution rates can limit the impact of productivity gains on wages. Existing studies yield no evidence of "low-wage traps".

The combination of an extension of these reductions with other major economic policy measures, as from 1998, complicates the task of evaluating the effects of this scheme from then on. In particular, the 2003 Fillon reform combined an extension of across-the-board reductions with convergence between the different minimum wages created when the "35-hour" week was introduced. Studies suggest that, in the aggregate, the additional reductions have offset the negative impact of the rise in low wages on employment.