Examining the Composition of VAT Revenues in France

Value added tax (VAT) is the largest source of tax revenue in France, standing at €202.7bn under budgetary accounting and representing 17% of the total tax burden in 2022. To examine the composition of VAT revenues, the French Treasury used a costing model that reconstitutes consumption bases subject to VAT. We then used these results to estimate the net revenue gain from a 1-percentage-point increase in all VAT rates, which we found to be €11.4bn.

Value-added tax (VAT) was introduced for the first time in 1954 by France and accounted for 17% of aggregate taxes and social security contributions in 2022. About half of VAT revenues accrues to the central government, while the other half is allocated to local authorities and to the social security system.

The costing model for theoretical VAT is a tool that combines tax and national accounts data to examine the composition of VAT revenues. Its purpose is to reconstitute consumption bases subject to VAT, i.e. to break down expenditure generating VAT revenues by type of product, by rate, by use and by type of consumer. The model makes it possible, for example, to determine how much of a specific product households consume (such as beverages) and to find out the breakdown between non-alcoholic beverages, which are subject to the reduced rate of VAT (5.5%), and alcoholic beverages, which are subject to the standard rate (20%).

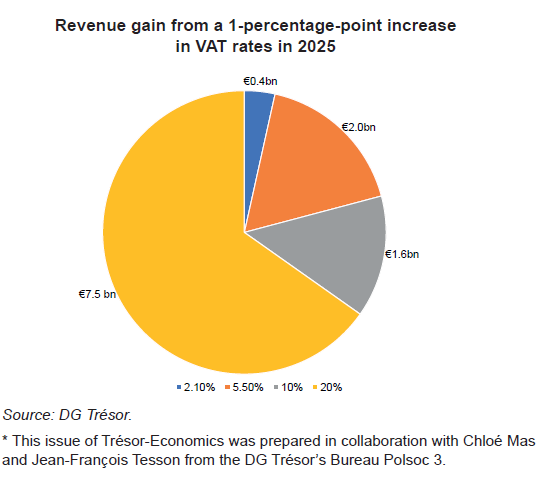

The model can estimate the fiscal impact of VAT reform by product and the cost of existing tax expenditures, excluding knock-on effects on consumer behaviour. For instance, the net revenue gain from a 1-percentage-point change in VAT rates is estimated to be €11.4bn in 2025.

VAT is a revenue raising instrument with a limited redistributive impact. The VAT burden weighs most heavily on high-income households, although it represents a slightly larger share of the income of low-earning households. Certain reduced rates affect high-income households more positively.