Minerals in the Energy Transition

The energy transition is expected to involve use of mineral-intensive technologies, with high demand for certain so-called “critical” or “strategic” minerals such as lithium, copper and rare-earth elements. In the short term, the global supply of these minerals should be sufficient to meet shifts in demand, even though the value chain is heavily concentrated, particularly in China. The possibility of shortages by 2050 cannot be ruled out, given the expected sharp rise in demand.

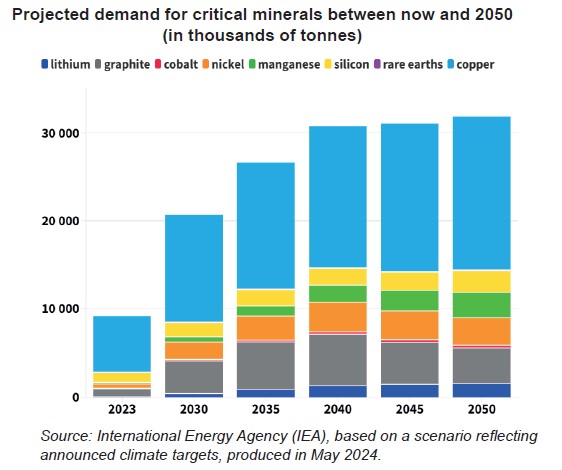

The energy transition is expected to involve use of mineral-intensive technologies, with high demand for certain so-called “critical” or “strategic” minerals such as lithium, graphite, nickel, manganese, silicon, rare-earth elements and copper.

In the short term, the global supply of critical minerals appears to be sufficient to meet the new uses related to the energy transition. Lithium and nickel prices have been falling since early 2023 against the backdrop of a sharp uptick in Chinese production and slowdown in global demand. Production nevertheless remains highly geographically concentrated, with a handful of countries holding a monopoly over the extraction of key critical minerals, and China now dominating refining and processing for the majority of these minerals.

Global demand could more than triple between now and 2050 in order to meet international and domestic environmental targets (see Chart below), with this spike in demand far exceeding current production levels for lithium, graphite and cobalt. Although many mineral-producing countries are eager to capitalise on their resources, the possibility of shortages cannot be ruled out – not least because the current low-price environment is weighing on the anticipated profitability of investments and new production sites, potentially leading to projects being postponed.

Many governments have responded to these risks, and to mounting geopolitical tensions, by introducing policies to secure and diversify supplies of critical minerals. At the same time, recent years have seen a sharp increase in trade barriers affecting these minerals, largely as a result of positioning strategies further down the value chain.