The Impact of Brexit on the United Kingdom's Economy

The UK’s withdrawal from the EU, which was voted for in 2016 and which became effective on 1 January 2021, has affected the British economy through three main channels. Trade with the EU has suffered, temporarily for goods and more lastingly for services. Business investment has declined since 2016 against a backdrop of uncertainty. The strain on the labour market has been heightened by lower employment levels for EU nationals.

The United Kingdom’s withdrawal from the European Union (EU), which was voted for by referendum in June 2016, became effective on 31 January 2020. After a transition period, the UK left the single market on 1 January 2021. Brexit has had an impact on the United Kingdom’s economy and has dampened its growth potential through three main channels.

Firstly, owing to the reintroduction of non-tariff barriers, the UK’s trade in goods with the EU fell in 2021 to a greater extent than trade with non-EU countries, although the impact only seems to have been temporary. On the other hand, trade in services with the EU has been more lastingly affected, especially for financial and transportation services.

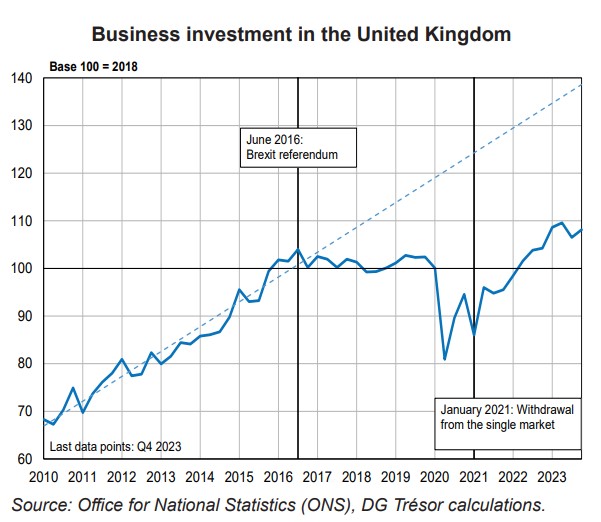

Secondly, business investment in most sectors has stalled since the 2016 referendum following a period of strong growth. Due to the effects of both Brexit and the COVID-19 pandemic, in Q2 2023, it was more than 20% below the level that it would have reached had it maintained the momentum seen between Q1 2010 and Q2 2016 (see Chart).

Lastly, restrictions on the employment of EU nationals have reduced the labour supply at a time when the UK’s labour market is under great strain. Employment of EU workers has levelled off since 2016 whereas it had rocketed during the years prior to the referendum. This has forced British employers to have greater recourse to non-European labour.