Interest Rates, Growth and Public Debt Sustainability

The trajectory of public debt as a percentage of GDP depends on the accumulation of annual primary public balances and the spread between interest rates and growth rates. Historically, in France and in the major advanced countries, this gap has been highly volatile, alternating between positive and negative periods. Analysis of the conditions that have enabled debt ratios to be reduced in the past shows that, in general, a negative spread is not sufficient in the absence of a primary surplus.

The sustainability of public debt depends on its long-term trajectory. This trajectory depends in turn on fiscal policies (i.e. the accumulation of annual primary balances) and the differential between the interest rate (r) and the growth rate of GDP (g).

If the primary balance is zero, the ratio of debt as a percentage of GDP increases, if the interest rate is greater than the growth rate (r–g>0) and it decreases in the opposite case. In the case of a primary deficit, the effect is more ambiguous: a positive r–g differential accelerates the increase in the debt ratio, while a negative differential contains the increase in the ratio and may even reduce it in some cases.

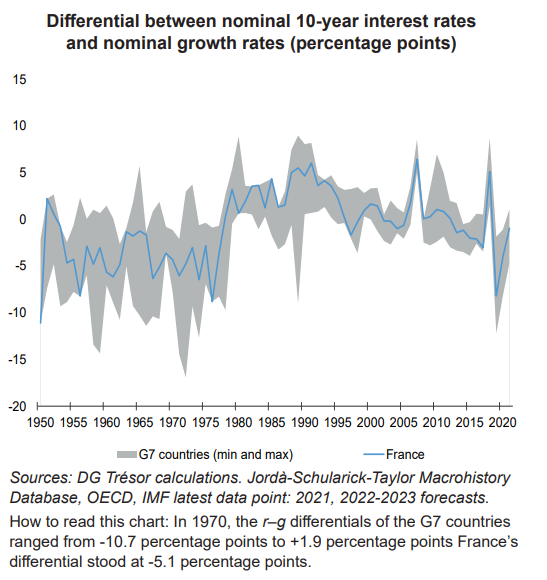

For France, and other major advanced countries, the interest rate-growth differential has been very volatile and positive over long periods (see Chart). Since the end of the 1990s, the interest rate-growth differential has narrowed for structural reasons, notably with excess savings at the global level which lowered risk-free interest rates, and even became negative in the past decade.

As measured by nominal borrowing rates, the differential could turn positive again in certain advanced economies as soon as 2023-2024, given the factors impeding growth and the surge in interest rates. As measured by the implicit interest rate, meaning the average cost of debt, the differential should remain negative in the medium term.

Caution is called for when using the observed interest rate-growth differential as a fiscal policy indicator, since it is impossible to foresee its future values. Furthermore, a negative interest rate-growth differential is not, generally speaking, sufficient to contain government debt in the presence of a primary deficit.

History shows that the link is not one-way, because the interest rate-growth differential is affected by the debt ratio: the greater the increase in the debt ratio, the greater the increase in the r–g differential.