World Economic Outlook in Autumn 2023: The Economy is Holding Out Against Rising Interest Rates

Global economic activity should hold up better in 2023 than forecast in the spring, but growth should be below its pre-crisis average in both 2023 and 2024. While activity in some economies should continue to benefit from catch-up effects, growth in advanced countries should be held back by the rise in financing costs. In the emerging countries, economic activity is likely to remain dynamic, despite a more limited rebound in China than expected.

Global growth is expected to slow to 3.0% in 2023, down from 3.5% in 2022. This is primarily due to the tightening of monetary policy to cut inflation. In 2024, the world economy should grow at the same pace (3.0%) which will still be below its pre-COVID average, as the continuing slowdown in advanced countries is being offset by more robust growth in certain emerging ones.

In advanced economies, economic activity held up better than projected during the first half of 2023. In Europe, the supply of energy this winter has been secured and the supply-chain problems facing businesses have eased. The slowdown in growth in 2023 and 2024 is chiefly the result of monetary tightening and its effect on investment. Each country’s growth path is also contingent on its residual catch-up capabilities following the COVID-19 pandemic, especially as regards consumption, which are greater in the euro area than in the United States, and on the extent of its exposure to world trade which is putting a drag on Germany in particular.

In emerging economies, growth is set to remain vibrant overall in 2023 but could show the first signs that it is running out of steam. As an example, China should experience a more limited recovery (+5.0%) than first forecast, due to the weak upturn in consumption and little support from the authorities against the backdrop of the real estate crisis. In 2024, it is estimated that most emerging economies will benefit from a reduction in inflationary pressure and the relaxing of monetary policies.

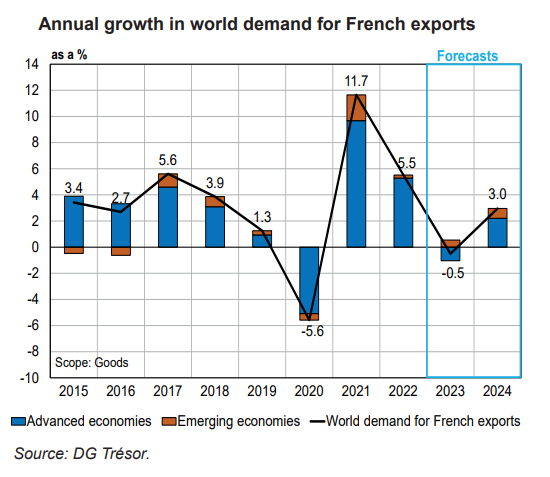

It is projected that world trade will slow significantly in 2023 in the wake of the severe contraction in trade during winter 2022-2023, before returning to normal levels in 2024. World demand for French exports (see Chart) should fall slightly in 2023 due to lower imports in advanced countries before bouncing back in 2024, driven by faster growth in the euro area.

The main risks to this scenario are changes to inflation and the effect of monetary policy on economic activity and on the financial sector.