The Market for Safe Assets

The holding and market of certain so-called safe assets play an essential role in financial stability. The definition of these assets is not consensual, as various qualities can contribute to the safety offered by a financial security: countercyclicality, liquidity, credit quality and stability. The study identifies a set of securities that play the role of safe assets according to these criteria and proposes an analysis of supply and demand for them over the last twenty years.

The holding of so-called “safe” assets, and the market for these securities more broadly, play a key role in maintaining financial stability. Yet there is no consensus as to how these assets are defined because the “safety” of a security depends on a number of different characteristics such as its stability, counter-cyclicality and liquidity, how transparently it is valued, and how solid its fundamentals are. The relative importance of these aspects varies according to investor preferences and financial-market conditions.

By examining how different asset classes perform against different safety criteria, it is possible to identify a universe of assets that can be considered “safe”, and to analyse developments in the market for these assets over the past two decades.

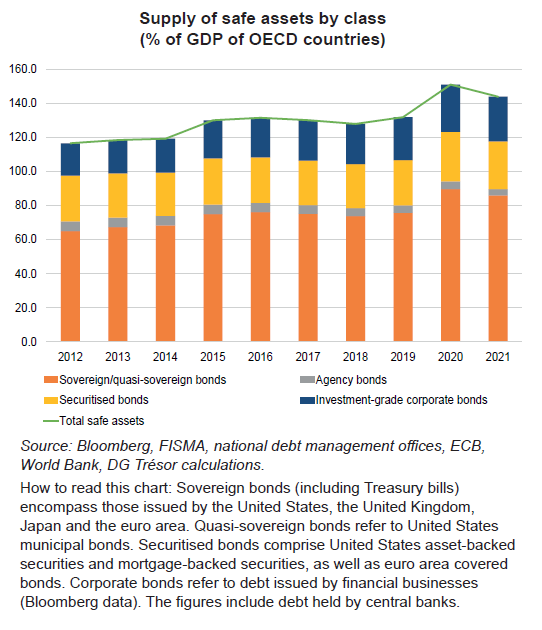

The supply of safe assets grew sharply in the 2010s, owing in part to sovereign bond issues. However, these assets became less readily available as central banks, especially in Europe, embarked on bond-buying programmes as part of a broader package of unconventional monetary policy measures. Despite increased supply, safe assets remained hard to come by throughout this period, as demand surged in both Europe and the United States, owing largely to the introduction of tighter prudential requirements in the wake of the 2008 financial crisis.

Globally, the market imbalance caused by these opposing forces has been partly redressed since the COVID-19 crisis of 2020, owing in large part to sovereign debt issues intended to fund pandemic support packages, which have had the effect of bringing the supply of safe assets into closer alignment with demand.

Looking ahead, the market could be affected by a number of major structural trends. Factors that could impact supply include the reshaping of the safe assets landscape amid the green transition, debt sustainability issues, rating downgrades and reform of the international monetary system. Meanwhile, demand could be influenced by developments such as the roll-back of unconventional monetary policy measures and changes to regulatory standards, especially those relating to non-bank financial institutions (NBFIs).