China's Public Finances: Short-Term Risks and Structural Issues

China’s public finances are organised in a complex and opaque manner, and are structured into various accounts with unclear scopes, along with off-balance sheet commitments. The important role of public investment in China's growth has resulted in high debt levels for local governments. In the wake of the COVID-19 pandemic, local finances are at risk, which has made far-reaching reforms all the more necessary.

Public finances have been a major driving force behind China’s growth, not least through public investment at the local level particularly since the 2008 crisis. In 2019, China’s public spending amounted to 24% of GDP according to official statistics, versus the 36% and 41% figures reported by the IMF and the OECD respectively.

Analysing China’s public finances is hindered by the lack of clarity in the definition of the prerogatives of various administrative levels (central, provincial, prefecture, county, city) in the Constitution of the People’s Republic of China and Chinese law, as well as by the fact that national laws often merely outline principles which are subsequently implemented at local level with significant leeway. The structure of public accounts is also based on opaque and complex methodology, lacking clarity on what spending falls within their scope, and the line between local and central government sometimes being blurred.

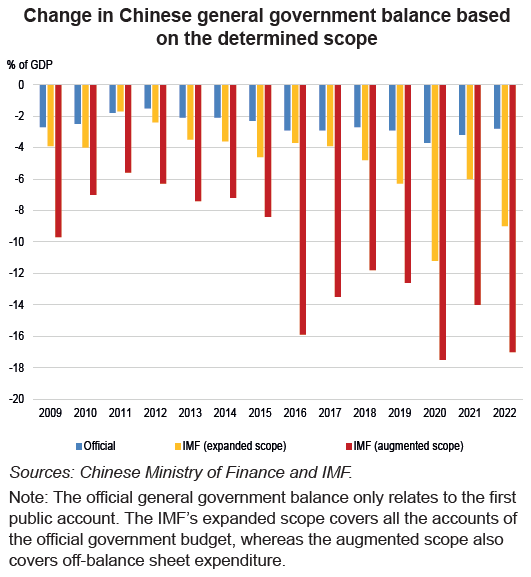

Public accounts structurally post a high level of deficit and debt. These two indicators have considerably worsened over the past few years, particularly as a result of the COVID-19 pandemic (see Chart). The situation at local level now emerges as a financial stability issue, with 57% of total government debt incurred at this level – according to official data – in a relatively

opaque way.

While local financial risks are high, a short-term systemic crisis seems unlikely given the guarantees granted by the central government and the fact that a large portion of the debt is held by major banks and local government entities.

Over the long term, imbalances and risks relating to public finances hamper growth and its necessary rebalancing, implying a shift from investments to domestic consumption. Despite the proactive stance of the authorities and the repeated recommendations of international observers, implementation of the reforms – a designated priority since 2013 – is still a slow and piecemeal process.