Decoupling of US and China Value Chains: Challenges for the EU

Since 2017, the US has adopted numerous decoupling measures in response to competitive distortions related to China's industrial policies. In response, China has adopted comparable countermeasures. These measures could affect EU exports to China of goods with US components, and EU exports to the US of goods with Chinese components. France would be among the most exposed EU countries.

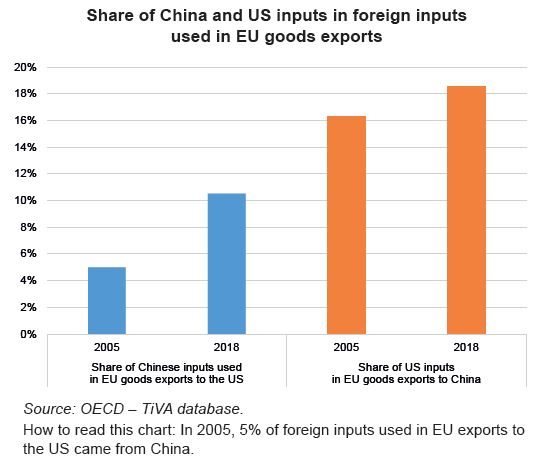

Over the past two decades, the approaches of the three main trading powers to global trade have changed significantly. While China and the United States have increasingly positioned themselves as suppliers rather than buyers of inputs within global value chains (GVCs), the European Union has done the contrary. Currently, the United States and China, respectively the number one and two suppliers of foreign inputs used in EU exports, are both engaged in a policy of targeted decoupling, which poses a challenge for the EU.

A significant proportion of EU goods exports to China contains US inputs (see chart). As a result, the EU may be affected by tighter controls by Washington on US exports to China, as these also apply to EU companies whose exports contain «critical» US inputs. France is among those EU countries that use the highest proportion of US inputs in their exports to China. Given the high proportion of Chinese inputs in EU exports to the United States, the EU and EU companies are also at risk from tighter controls introduced by China on their exports to the United States, which mirror those implemented by the US administration. In this case as well, France is one of the EU countries with the greatest exposure.

Against a broader backdrop of increased geopolitical tension, the EU is bolstering its trade policy and support for industry in order to reduce its dependence on third countries in areas such as semi-conductors, while maintaining openness to trade. Its aim of «strategic autonomy» will help to minimise the knock-on effects that a decoupling by the United States and China could have.