Debt in Sub-Saharan Africa

Since the cancellation of the Heavily Indebted Poor Countries initiative, sub-Saharan African countries have re-debted and their debt composition has become more complex. The Covid-19 crisis exacerbated these vulnerabilities and led the Paris Club and the G20 to implement multilateral initiatives. Beyond the debt service suspension initiative, the Paris Club and the G20 agreed on a common framework for debt treatment of vulnerable countries.

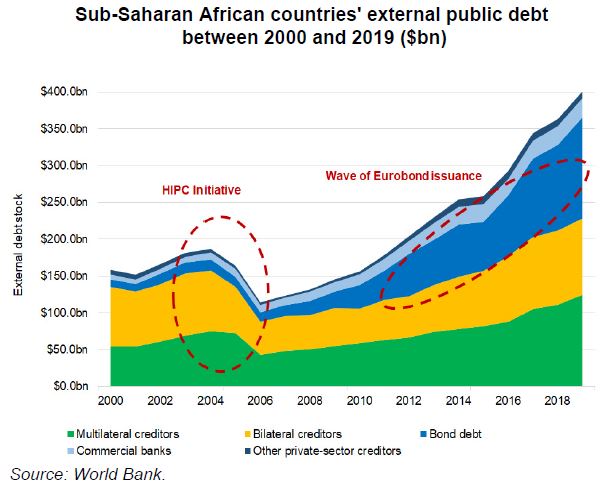

Following the cancellations of sovereign debt in the early 2000s under the Heavily Indebted Poor Countries Initiative, Sub-Saharan African countries' external debt stocks have increased sharply once again. These debts have increased threefold since 2006, the year that saw the lowest levels following the cancellations.

The composition of creditors has changed, with private-sector creditors holding a share of sovereign debts which soared by 14 percentage points between 2009 and 2019. This change reflects the increasing number of countries issuing debt securities on international capital markets. Furthermore, China is now the largest bilateral creditor for Sub-Saharan Africa (SSA), holding 62% of the region's bilateral debt in 2019.

This rapid rise in new debts is a source of severe vulnerabilities because of the complexity of the debt instruments used. The reliance on capital markets has created significant refinancing and exchange rate risks. Furthermore, the lack of transparency surrounding collateralised loans may increase the risk of debt distress and make any potential debt treatments more complex.

The COVID-19 pandemic has exacerbated pre-existing vulnerabilities. In early 2020, uncertainty and foreign investors' perception of greater risks deprived some Sub-Saharan African countries of access to foreign capital markets, before the situation returned to normal in the second half of 2020. On this occasion, multilateral institutions stepped up and played a countercyclical role by releasing massive emergency funds ($230bn between April 2020 and mid-2021).

In addition, the Debt Service Suspension Initiative (DSSI), introduced by the G20 and the Paris Club, enabled low-income Sub-Saharan African countries to free up large amounts of liquidity to cope with the pandemic. The G20 and the Paris Club members have agreed for the first time to go beyond a temporary measure and set up the Common Framework for Debt Treatments beyond the DSSI for these countries

.