Trésor-Economics No. 62 - How does today's US crisis compare with the 1990s Japanese crisis?

Both the American and the Japanese crises originated in the bursting of speculative bubbles, forcing private agents–households in the case of the USA, and non-banks in the Japanese case–to reduce their debt. In the case of Japan, debt reduction in the midst of a financial crisis triggered a deflationary spiral. A Japanese-style deflationary spiral seems unlikely in the United States, despite similarities regarding the depth of the financial crisis and the scale of the excesses needing to be unwound.

Japan entered a deflationary spiral in the wake of a protracted depression as a result of a series of specific factors, some internal (such as the length of time taken to bring hidden doubtful assets out into the open), and some external (e.g. the Asian crisis and the appreciation of the yen), at a time when the economy was already extremely fragile.

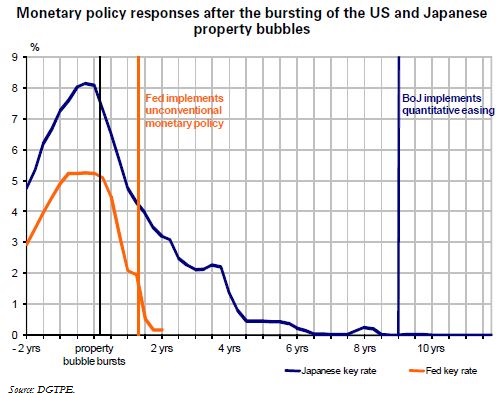

A highly aggressive economic policy response could enable the United States to avert a deflationary spiral. The American authorities are concentrating on avoiding repeating the mistakes of their Japanese counterparts. Their management of the crisis appears to have been more responsive ex ante, and more ambitious in scope, with a series of rapid, targeted and large-scale stimulus plans, aggressive rate-cutting, unconventional monetary policy measures, and the creation of a defeasance structure to buy-up "toxic assets".

The drop in consumer prices on a year-on-year basis observed in the United States since March 2009 is mainly attributable to a base effect on energy prices. This is likely to be temporary only.