Trésor-Economics No. 204 - The Argentinian economy - achievements and challenges

Since President Mauricio Macri's election in late 2015, Argentina is once again gaining ground, following the 2001 economic crisis and a period dominated by a return to protectionism and creeping isolationism with respect to foreign investment. In a bid to deal with a particularly depressed macroeconomic climate and ward off a new currency crisis, the country successfully implemented difficult emergency measures: the peso was allowed to float, capital controls were lifted, talks were held with holdout bondholders to end the default. Implementing structural reforms is a longer-term process.

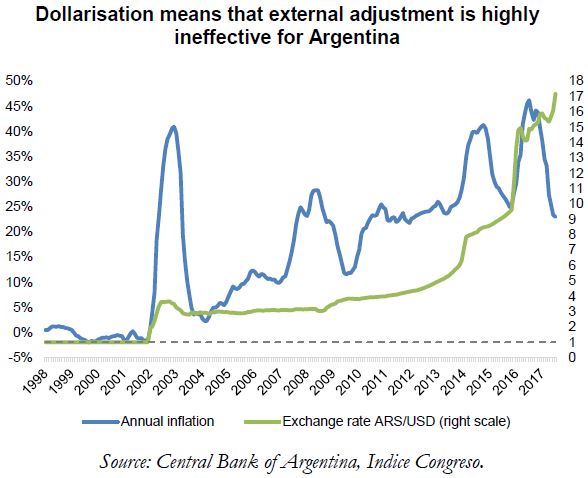

One of the keys to macroeconomic normalisation lies in Argentina's ability to quickly rein in inflation and modernise its financial sector. Inflation inertia has been a feature of many of the economic crises that the country has suffered, as stakeholders' preference for the dollar fuels strong resistance to any real exchange rate adjustments.

Inflation inertia also has structural roots, including rent-seeking behaviour facilitated by trade protectionism and weak enforcement by competition authorities, as well as difficulties in reining in wage costs in the face of trade unions' negotiating power. In a cyclical manner, the removal of distortions linked to public services subsidies is accompanied by a rise in inflation.

Currently, the Central Bank is faced with a dilemma – should it extend a restrictive monetary policy or, by adjusting the exchange rate in a bid to bolster poor price competitiveness, opt for a more gradual path to disinflation?

In the short term, the gradual opening up of trade that was initiated by the government is clearly the best way to instil greater discipline in price setting and the formation of expectations, thereby quickly erasing the loss in exchange rate competitiveness. The success of these normalisation efforts after a painful past would be promising for medium- and long-term growth, given Argentina's many strengths (raw materials, human capital and a productive agricultural sector, among others).