Trésor-Economics No. 186 - Economic risks and rewards for first-time sovereign bond issuers since 2007

(Update on June 15, 2017)

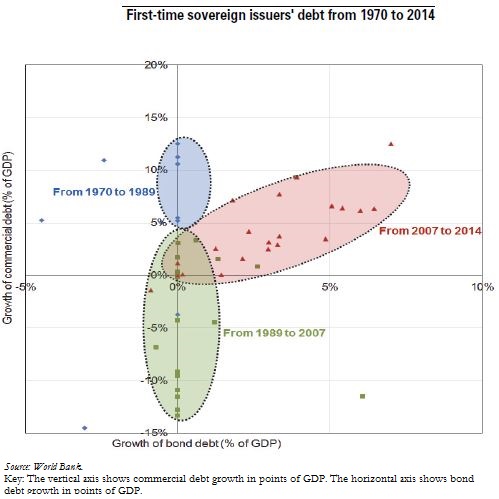

Back in 1989, the Brady Plan enabled developing countries to extricate themselves from a solvency crisis that had severely hampered their growth throughout the 1980s. Under the Plan bank loans to these countries were exchanged for bonds with lower face values and longer maturities. The success of the Plan marked a turning point for middle-income countries (MICs). They started borrowing less and less from banks and raising more and more funds on international bond markets.

However, the least developed countries (LDCs) were not part of this trend for some time. It was not until after 2000, and 2007 in particular, that the LDCs gained access to foreign bond financing, as a result of a global economic recovery, combined with rising commodity prices and investors' growing appetite for high yields.

Twenty-six low- and middle-income countries were deemed to be first-time issuers on international bond markets between 1 January 2007 and 31 December 2015. Their issuance over the period consisted of 85 bonds for an amount of USD 58.7 billion. This amount grew substantially between 2013 and 2015, since 64.4% of the total issuance amount was issued during those years.

The individual economic and financial circumstances of first-time sovereign issuers may vary, but their bonds are generally subject to major exchange rate risks and refinancing risks. In addition, the settlement that Argentina reached with holdout funds on 29 February validated the holdouts' strategies and made the outstanding bonds of any country in financial trouble more vulnerable.

Work published by the International Monetary Fund (IMF), the International Capital Market Association (ICMA) and the Institute of International Finance (IIF) after October 2014 made it possible to include clauses in bond contracts that provide better protection against holdout funds' actions and ensure efficient and rapid restructuring processes. Nevertheless, a large share of the first-time issuers' outstanding bonds is not protected by most recent clauses. Furthermore, even though first-time issuers seem to have adopted modified pari passu clauses and collective action clauses with menus of alternative voting procedures, clauses designed to coordinate private noteholders' actions are not yet in wide use.