Trésor-Economics No. 157 - Impact of falling oil prices on the major emerging economies

The decline in oil prices affects emerging economies in different ways, having an adverse impact on oil-exporting countries and a favourable impact on oil importers.

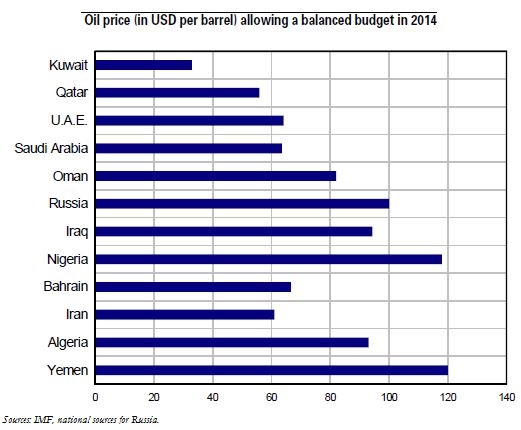

For oil exporters, lower oil prices mean lower exports in value terms. The loss of oil revenue has an adverse impact on the fiscal balance and, more broadly, on domestic demand as a whole. Depending on the budgetary and monetary policy space that is available, governments can offer varying degrees of support to their economies to soften this negative shock.

In contrast, oil importers reap the benefits of lower energy costs, which translate to purchasing power gains for households and lower production costs for firms. Moreover, lower inflation rates can lead central banks to ease monetary policy. And falling oil prices lead automatically to a dip in energy subsidies while creating an opportunity to reduce them even further.

The difficulties encountered by oil exporting countries can have a negative impact on their trading partners and on the countries that are most reliant on the financing they provide. Exporting countries ran a current account surplus equivalent to 7% of GDP in 2013, which the IMF says will turn into a deficit of 1.6% of GDP by 2016. Oil exporters reinject some of their revenue into the global economy, via investments in sovereign funds for example. As a result, the drop in oil prices can lead to a reduction in capital inflows and tighter financial conditions in the oil-importing countries that typically benefited from such investments.