Trésor-Economics No. 138 - What outlook for the French automobile industry?

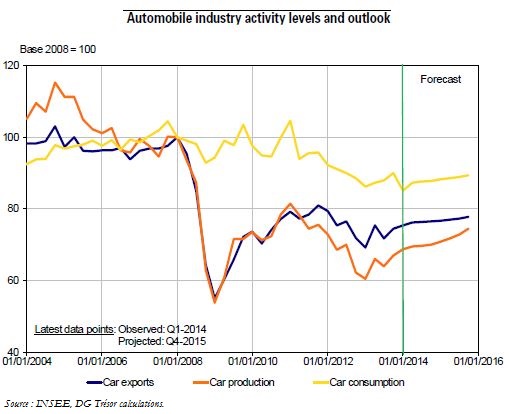

French carmakers, along with the rest of the European automotive industry, had to cope with a sudden drop in demand triggered by the 2008 crisis. Several European countries, including France, introduced temporary measures, such as scrapping subsidies, to underpin demand and ease the industry's difficulties, thus giving carmakers more time to adapt to new conditions and cope with a crisis that was seen as cyclical at the time.

These measures were phased out in a persistently weak economy and the downturn in the European market recently drove demand down to very low levels. Sluggish demand has resulted in sizeable overcapacity throughout Europe. Several structural factors, such as a high car ownership rate and persistently high fuel prices, combined with a weak economy, are likely to restrict any recovery in demand in both France and the leading European markets.

Under the circumstances, carmakers in Europe will have to continue reducing the overcapacity revealed by the crisis. Investment in eastern European countries prior to 2008 built up automobile capacity to such an extent that it now outstrips the current level of demand. Overcapacity fuels competition between production plants and erodes the profitability of French carmakers, who were already lagging behind in terms of competitiveness before the crisis because of a poorly positioned product range and weak international expansion.

Restructuring of production plants should continue in France in the short term, given the persistently low capacity utilisation rate and the urgent need to make competitiveness gains. In the longer run, the growth of the automobile industry in France will depend on carmakers' ability to keep pace with changing demand (energy transition issues, development of connected vehicles).