Trésor-Economics No. 117 - Are safe assets to become scarcer?

Safe assets, i.e. highly liquid assets with a very low default risk, play a key role in the global financial system. They can, for example, offer a safe haven to investors or be used as collateral in transactions between financial entities.

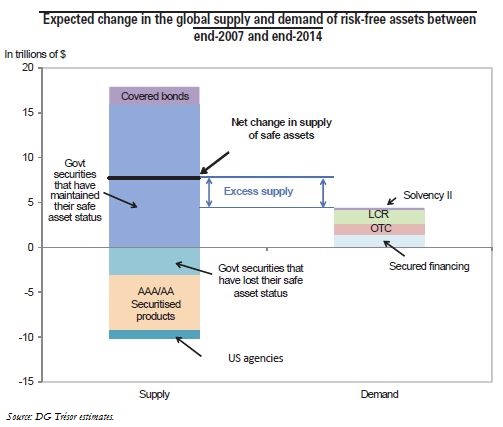

With some of these assets losing their risk-free status in the wake of the recent financial crisis, and with demand for safe assets expected to exhibit structural growth, particularly as a result of prudential reforms, some analysts are worried that risk-free assets may become increasingly scarce.

Despite these developments, the relative increase in the supply and demand of safe assets, which began in 2007 and is set to continue up to 2014, indicates that there is little danger of this asset class becoming scarce on a global scale.

During the same period, the global supply of safe assets is likely to grow substantially on the back of an increase in government bond issues in OECD countries and despite the disappearance of certain large-sized bonds from this asset class along with some securitised products that previously enjoyed a strong credit rating.

That said, these global developments mask the strong disparities between monetary areas. More specifically, while the situation in the US does not appear to be giving cause for concern, the euro area seems to be more problematic. Nevertheless, the danger that these safe assets might become increasingly rare within the euro area has dissipated considerably following institutional reforms in Europe and the launch of the ECB's Outright Monetary Transactions (OMT) programme.