Trésor-Economics No. 116 - Residential mobility and labor market adjustement

In France as in most OECD countries, the homeownership rate has been on an upward trend (58.1% of households in 2011, a 5-point rise over 1985). However, home ownership is associated with higher costs of mobility than renting. This being the case, a contraction of the rental market could have negative effects on job match quality. For example, Oswald (1996), followed by other economists, estimates that that in various countries, a 10 percentage point rise in the owner-occupation rate is associated with an increase of approximately 2 percentage points in the unemployment rate.

However, Oswald's estimates suffer from certain weaknesses. His hypothesis has come under some criticism in the economic literature, sometimes even being contradicted by empirical data. In the particular case of France, homeowners have a lower probability of being unemployed than private renters. However, most of detailed studies regarding French situation confirm that the type of housing tenure does indeed influence professional mobility and exit from unemployment. The costs involved in relocation, which differ according to the type of residential tenure, are thought to penalise labour market matching.

Thus, in France, all other things being equal, being a owner-occupant or a social-housing renter could limit professional mobility that require relocation. This result appears to reflect the higher costs of mobility incurred by homeowners and social renters: homeowners are confronted with high transaction costs, a major share of which in the form of "solicitor's fees," while renters of social renters run the risk of losing their access to social housing if they move.

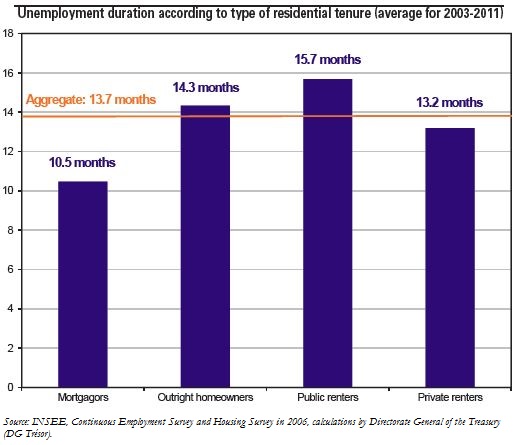

Also in France, all other things being equal, the average duration of unemployment is longer for homeowners who have paid off their mortgages ("outright homeowners") and for of social renters than for private renters or homeowners with an outstanding mortgage ("mortgagors"), with no significant difference between the latter two categories. These results are consistent with the negative impact that the cost of relocation has on exit from unemployment, when the financial incentive of paying off a mortgage is taken into account. Specifically, mortgagors are more willing to accept a job offer in the local labour market than are other categories of residential tenure.

Results concerning the quality and nature of the jobs, on the other hand, are more ambiguous.

Finally, in the United States, being a homeowner-occupant rather than a renter has no effect both in terms of professional mobility and duration of unemployment spells. In Britain, the effect on unemployment duration is very small. These results may be related to the low costs of property transactions in both countries.