Trésor-Economics No. 63 - The French employment premium and its beneficiaries, 2001-2008

The French employment premium, called "Prime Pour l'Emploi" (PPE), was introduced in 2001 to give incentives to people to go to back to work and to provide financial support to low-paid workers.

The PPE is a tax credit granted to households that earn below a specific ceiling for taxable income and is based on labor income of each of its members. The PPE-scheme has been substantially revised since its inception: the amount of the PPE has been doubled for full-time workers earning the SMIC, and quadrupled for part-time workers earning the SMIC. The cost to the budget of the PPE has risen from €2.5 billion in 2001 to €4.5 billion in 2008.

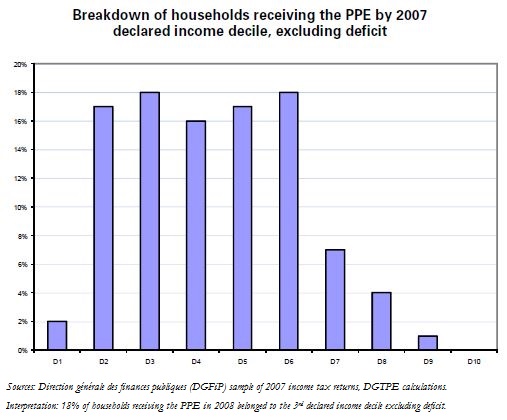

With its scale ranging from 0.3 to 1.4 and even 2.1 times the SMIC for single parents or couples with one working partner, the PPE has reached a quarter of all tax households since its inception. Beneficiaries are mainly younger households, for the most part blue-collar and clerical workers, with few qualifications and tending to lie between the second and sixth income deciles (see chart).

Flows entering or leaving the scheme represent around 30% of the total number of beneficiaries each year. Young households entering the labour market for the first time, or returning to work after a period of unemployment enter the scheme «from below». People leaving the scheme are evenly distributed between the top end and the low end of the scale, as their income either rises or falls, in the latter instance due for instance to a loss of employment or to retirement.

Other factors independent of the labour market may play a role in conditioning eligibility for the scheme, such as a change in the structure of the tax household or a revision of scale thresholds.