Trésor-Economics No. 61 - The "Revenu de Solidarité Active" or earned income supplement: its design and expected outcomes

The introduction of the "revenu de solidarité active" (RSA) or earned income supplement, 20 years after the launch of the "revenu minimum d'insertion" (RMI) or minimum integration income, seeks to correct several shortcomings in the French welfare system. These include a generally inconsistent and confusing maze of transfers and taxes or contributions, weak incentives to return to work, and the inadequacy of the traditional tools of social and wage policy in addressing the problem of the "working poor". This new benefit consequently seeks to tackle the problem of poverty despite working and to encourage people to return to work.

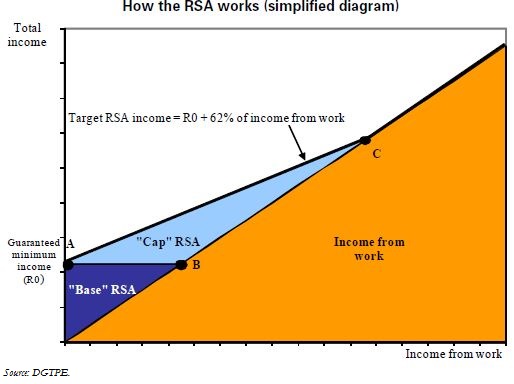

Under the RSA, disposable income rises in line with income from work: depending on the beneficiary's family circumstances, the guaranteed minimum income paid to those not working (the "base" RSA) corresponds to the former RMI and the API single parent allowance; as income from work rises, this can be combined with a fraction (62%) of the income from work to form the so-called "cap" RSA. The new system also strengthens the mechanism for helping people back to work, steering beneficiaries in the first place to "Pôle Emploi" (Job Centre), where they will deal with a single designated adviser.

The new component, the "cap" RSA, is expected to apply to 1.8 million households (comprising 5.1 million people) every quarter, and 2.4 million households at least once a year. The "cap" RSA is expected to provide an additional income of €130 per month, thereby boosting the incremental income from working, especially for couples where only one partner works and for single-parent families. This would reduce the poverty rate by 0.8 percentage point, enabling 500,000 people to escape from poverty. Without eliminating the risk of poverty while in work entirely, the RSA will improve living standards for low-paid workers. These effects are expected to occur assuming no change in behaviour. The RSA is also intended to affect labour supply and demand behaviour; this paper does not examine these "dynamic effects".

There is nevertheless room for further improvement in the effectiveness and clarity of the benefits system. Consideration could be given notably to articulating the RSA more effectively with housing benefit, the "prime pour l'emploi" (PPE) or employment tax credit, and other benefit mechanisms.