Trésor-Economics No. 35 - Real exchange rate appreciation in the emerging countries

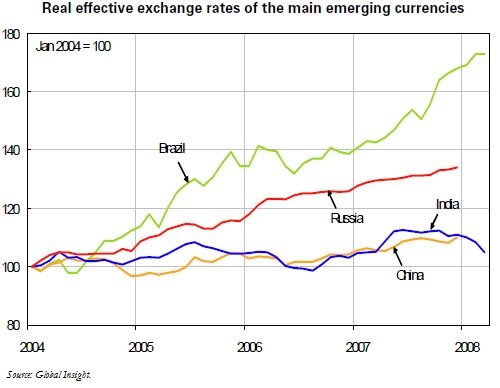

The catching up economies have experienced sharp productivity gains, and their currencies are under pressure to appreciate in real terms against the developed countries' currencies. Until July 2007, in most cases these resulted in significant nominal appreciations, while at the same time we saw rising inflationary pressures. This process, which is essentially structural in origin, has been amplified by the combination of other factors, namely: a sharply falling dollar against all currencies, buoyant global economic conditions, very high levels of liquidity in the world financial markets, and surging commodities prices.

Most countries concerned have responded to this phenomenon by seeking to limit this appreciation, as it is eroding their competitiveness. The classic economic policy options, such as constituting foreign exchange reserves, sterilisation, and interest rate management, have been thwarted by the impossibility of simultaneously controlling exchange rates and preserving an independent monetary policy (with domestic objectives) in a context of free movement of capital and increasing international integration. This has led to other measures being considered, and in particular intervention in the control of capital flows, either by encouraging outflows or by restricting inflows.

Since July 2007 and the onset of the subprime crisis, and above all since its aggravation from January 2008 onwards, the emerging currencies have experienced more contrasting and more volatile fluctuations. The economies of the countries concerned face hard economic policy choices as between pressures for a real appreciation, essentially in the form of short-term inflationary pressures, and a possible cooling, albeit limited, resulting from the economic slowdown in the developed countries in the medium term.