Trésor-Economics No. 14 - Labor market adjustment dynamics and labor mobility within the euro area

Moving to a single currency has reduced trading costs, enhanced price transparency and increased financial stability. However, the euro area is sometimes subject to asymmetric shocks. In order to respond to these shocks, EMU Member States can rely on appropriate national policies, or other real dynamics adjustment mechanisms, such as real competitiveness adjustments or the mobility of production factors, such as capital and labor.

Two papers from the 1990s showed that labor mobility was lower within the European Union than in the United States, and that most of the shocks' effects were absorbed by changes in the participation rate on labor markets rather than migrations. The following paper compares labor market adjustment mechanisms in the euro area and in the United States, taking into account recent labor market data.

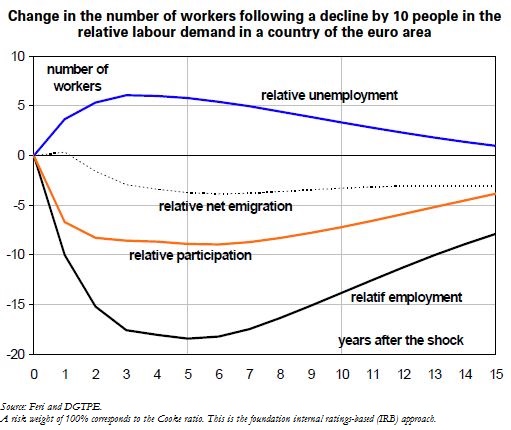

The paper models labor market dynamics between 1973 and 2005. Results suggest that labor mobility in response to asymmetric labor demand shocks is lower in the euro area than in the United States. A decrease in relative labor demand (in other words subtracting the decrease for the euro area as a whole) by 10 workers the first year is associated with a relative increase in net out-migration of 3 workers after 15 years in the euro area, compared to 9 workers in the United States. Changes in labor participation are a stronger adjustment mechanism in the euro area.

Estimates based on a more recent period (1990-2005), however, indicate that the reactions of European labor markets to asymmetric shocks have become closer to those observed in the United State. The contribution of labor participation to the adjustment process appears to have diminished, and relative movements of labor forces between Member States seem to have become a more efficient adjustment mechanism.