The Consequences of Regulating Mortgage Lending Conditions

In response to rising mortgage debt for households, regulation of mortgage lending conditions for households was introduced in France by the Higher Council for Financial Stability. An assessment has shown that this measure, which became binding in 1 January 2022, has reduced the average DSTI ratio while increasing the average mortgage maturity. However, the effect on property prices has been limited amid interest rate increases.

An increase in household mortgage debt was the catalyst for the decision made by the macroprudential authority – the High Council for Financial Stability (HCSF) – to regulate mortgage lending conditions for households in France. In 2019, the HCSF published a recommendation for credit institutions to limit the debt service to income (DSTI) ratio – the share of income allocated to monthly mortgage repayments – and the maturity of the mortgages approved. This recommendation became legally binding in 2022.

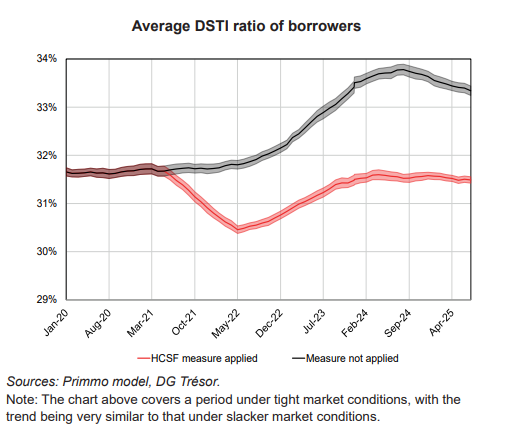

The Primmo model was used to assess this regulation, taking into account the varying impact that government policies may have depending on actual observed interest rates. This assessment showed that the HCSF’s measure had enabled the average DSTI ratio to be reduced while increasing the average mortgage maturity. However, the effect on property prices is limited amid rising interest rates. The findings are in line with the studies presented in the HCSF’s 2024 Annual Report.

When using the variation in the average income of buyers in the model as a proxy of the exclusion of households, the analysis reveals that lower-income households are “excluded” from the credit market due to high interest rates, but that this is not compounded by the HCSF measure.

If the HCSF had not applied the measure, the average DSTI ratio would have risen while the average mortgage maturity would have decreased. However, this would not have had a major effect on transactions and property prices within one year, as short-term market momentum is primarily influenced by the interest rate environment.

The model can also be used to examine the effect of exogenous shocks – relating to interest rates, as well as construction and rent – on the property market’s momentum and the profile of borrowers.