How Crises Are Putting IMF Financial Support to the Test

The IMF remains, as it has been since 2020, a central player in crisis response. Since its creation in 1944, it has been able to rethink its historical instruments such as the Special Drawing Rights and evolve its toolkit to respond to the shifting crises affecting its membership. Today, to continue to ensure the stability of the international monetary system, the IMF is seeking to strengthen its ability to address more structural challenges such as climate change.

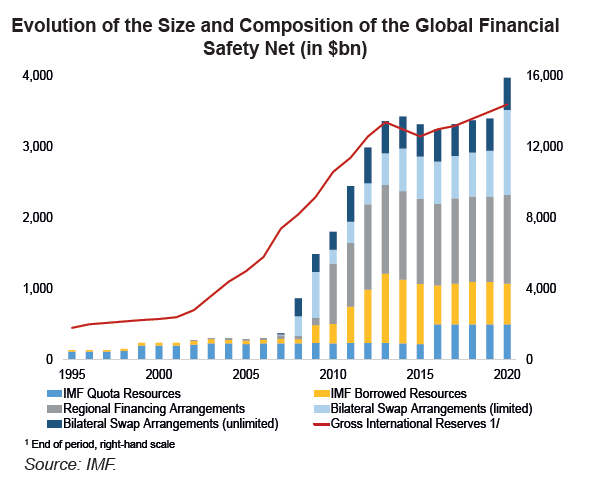

The COVID-19 crisis and Russia’s war against Ukraine have heightened the vulnerability of emerging market and developing countries, adding to their existing burden of structural challenges. Such countries, constrained by more limited fiscal headroom and sources of liquidity, are more likely to resort to the International Monetary Fund (IMF) for financial support than their advanced economy counterparts. The Fund has regularly adapted its toolkit to ensure the stability of the international financial system. Although new sources of liquidity have emerged, the IMF continues to play, alongside the World Bank, a catalytic role at the centre of the international monetary system, as illustrated by its essential part in managing the pandemic-induced crisis since early 2020.

Created at the outset to supplement the foreign exchange reserves of its member countries, the IMF’s special drawing rights (SDRs) have played a major role in addressing both the 2008 financial crisis and the COVID-19 crisis, with a general allocation of SDRs equivalent to $650bn approved in August 2021. To magnify the allocation’s impact on vulnerable countries, France and other major advanced economies have pledged to channel a portion of these new SDRs to them in order to fortify the IMF’s concessional lending window, the Poverty Reduction and Growth Trust (PRGT), and allow the creation of the IMF’s Resilience and Sustainability Trust (RST), which aims to support the resilience of economies to structural challenges such as climate change.

The financial support provided by the IMF has been sparking debate since the institution’s founding. In 2020, the IMF’s unprecedented allocation of emergency financing prevented the financial collapse of many countries, but its role as lender of first resort came to a certain extent at the expense of its ability to address structural imbalances in countries receiving assistance. The IMF’s determination to fulfil its mandate and tackle new structural challenges such as climate change has led it to provide long-term concessional financing instruments, raising the issue of the boundaries and terms of cooperation between the IMF and development institutions. Against this backdrop, by the end of 2023, IMF shareholders are set to reach an agreement on the adequacy of the size of Fund resources and on a possible realignment of quota shares to the benefit of emerging market economies.