The Crypto Boom: Challenges and Risks

Crypto-assets refer to a multitude of heterogeneous assets, which, although they are used relatively little as a means of payment, constitute an increasingly widespread asset class, supported by the development of a financial ecosystem and the emergence of decentralised finance. However, they present various limitations and risks for investors, highlighted by the violent correction episodes that have occurred over the past year, justifying the introduction of an appropriate regulatory framework.

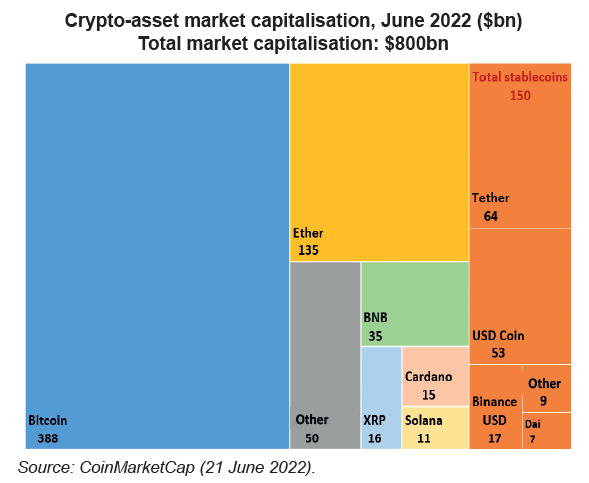

Crypto-assets are commonly defined as any digital asset based on blockchain technology. These assets have grown tremendously over the last few years and now refer to a diverse asset class with multifarious functions and challenges. Aside from crypto-assets built on well-established blockchains, such as Bitcoin and Ether, there are many tokens – issued through applications that are decentralised to a varying degree – that contribute to the crypto ecosystem’s growth. Stablecoins, a type of crypto-asset whose value is pegged to one or more assets (which is supposed to ensure a stable value) have also experienced significant growth and play a pivotal role in the crypto sector by providing a bridge to traditional finance.

Although crypto-assets have not been widely used as a means of payment, the asset class can offer yield and diversification to those who can endure large bouts of price volatility. Crypto-assets are also used as vehicles for transferring funds, particularly across borders. A substantial financial ecosystem has taken shape, one that has attracted institutional and retail investors alike. Crypto-assets are also at the heart of the “decentralised finance” movement, whose advocates claim would reduce the friction in transactions that results from intermediation.

Having said that, crypto-assets face persistent headwinds – slow and expensive transactions, energy consumption and security threats – that make it difficult for the market to gain traction, as reflected by the sharp contractions observed since May 2021. Crypto-asset markets also have several vulnerabilities, including a high degree of concentration, liquidity risks, and exposure to market risk. These weaknesses create challenges for financial stability, even though the market capitalisation of crypto-assets, which contracted threefold since November 2021, remains modest compared to other asset classes (about $800bn in June 2022 versus approximately $25tn for the New York Stock Exchange and $11tn for gold).

Effective regulation of crypto-assets is crucial for the sector and related technologies to grow, while protecting investors, ensuring financial stability, and combating money laundering and terrorist financing. Efforts are underway in the form of the PACTE Act in France, the Markets in Crypto-Assets regulation (MiCA) which is being finalised in Europe, and a number of prudential regulations.