The ruble that hides the forest

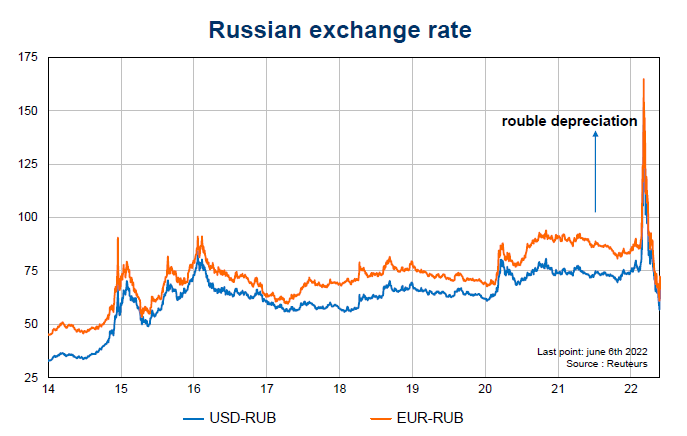

The effectiveness of economic sanctions is notoriously difficult to estimate because of the multiplicity of instruments, intermediate and ultimate objectives, intensities (number of countries, products, years, etc.), but also because of the difficulty of defining the counterfactual scenario (see, in particular, Trésor-Economics (2015) or, more recently, Felbermayr et al. (2020). How should the spectacular recovery of the ruble since mid-March be interpreted, after its sharp depreciation during the first weeks of the war (see Figure)?

Figure.

Budget revenues boosted hydrocarbon prices in the short term

Since the invasion of Crimea in 2014, Russia has averaged a per capita growth rate of only 0.5% per year. However, the macroeconomic situation was healthy in 2019, with public debt at only 19% of GDP, a budget surplus of 1.9% of GDP, an unemployment rate of 4.6% and a current account surplus of 3.9% of GDP, despite somewhat high inflation at 4.5% (see table, first column). In 2020, the decline in GDP was relatively limited, thanks in particular to substantial budgetary support. The budget balance deteriorated to -4% of GDP as a result of the support measures, but also of the drop in revenue linked to energy exports, which represented around 40% of budgetary resources in 2019.

Table. International Monetary Fund Spring forecasts for Russia

|

|

2019 |

2020 |

2021 |

2022 |

2023 |

|

GDP growth (%) |

2.2 |

-2.7 |

4.7 |

-8.5 |

-2.3 |

|

Consumer price inflation (%) |

4.5 |

3.4 |

6.7 |

21.3 |

14.3 |

|

Unemployment rate (% of the labour force) |

4.6 |

5.8 |

4.8 |

9.3 |

7.8 |

|

Government budget balance (% of GDP) |

1.9 |

-4.0 |

0.7 |

-4.0 |

-5.3 |

|

Current account (% of GDP) |

3.9 |

2.4 |

6.9 |

12.4 |

8.1 |

Source: International Monetary Fund, World economic outlook database, April 2022.

In economic terms, the first effect of the war was a tripling of the trade surplus: from January to April 2022, Russia had a cumulative trade surplus of $106.5bn, compared to $35.2bn in the first four months of 2021, according to the National Bank of Russia. This tripling is the result of the rise in hydrocarbon prices (much of which occurred before the outbreak of the war) and the collapse of imports. As a matter of facts, Western and Chinese exports to Russia fell by around 40% in value between February and March 2022. According to FourKites, Russian import volumes were down 89% in May 2022 compared to February.

With rising export revenues, falling imports and initially tight exchange controls, the recovery of the ruble is not a surprise, as Itskhoki and Mukhin (2022) have shown. In a way, Russia is accumulating too much foreign currency for its needs, as it can no longer use it to buy goods, services and financial assets abroad. The withdrawal of Western multinationals from Russia cannot be considered as a capital outflow when the counterpart is a provision for losses in the accounts of the parent companies. Itskhoki and Mukhin show that, for the Russian economy, restrictions on Russian imports have the same effect as restrictions on exports combined with a freeze on foreign assets: in both cases, imports, production, tax revenues and national income are bound to decline in the near future. But in the first case the ruble appreciates (as has been observed), while if Russian exports fall without the central bank being able to intervene in the foreign exchange market, the ruble depreciates.

In the first four months of 2022, Russia's budget revenues increased by about 34% compared to the same period in 2021, according to the National Bank of Finland's Emerging Economies Research Centre. Of the 40% of energy-related budget revenues, 4/5 come from the sale of oil. According to the same research centre, these revenues increased significantly with the price increase during 2021, and continued to increase after the start of the war, despite the discount on Russian oil - about $30-35 per barrel. However, other tax revenues fell by 20% in March and April compared to the previous 12 months. In particular, VAT revenues were halved despite inflation of over 17% year-on-year.

Expenditure is also up by 25% in the first four months of the year compared to 2021. This is due to the war itself, to government support to the economy and to households, and to inflation. The fiscal situation has started also to deteriorate as a result of the decline in oil production of around 10% in April 2022 compared to the first three months of the year.

The good performance of the ruble is not of much help when imports are constrained: the external purchasing power of the currency is largely theoretical as it is impossible to obtain goods from advanced countries.

Exports do not necessarily make you richer

Russia's trade surplus is a collateral effect of the war, not an objective of the Russian government. Nevertheless, it illustrates how misleading is the external balance to assess a country's enrichment. According to estimates by the Russian Ministry of Economic Development, GDP would have fallen by 3% between April 2021 and April 2022. The Ministry explains this decline by the pressure of sanctions, in particular logistical restrictions and the decline in domestic demand. Retail sales decreased by 9.7% over the same period.

According to the International Monetary Fund (see table above), Russia's GDP could fall by 8.5% in 2022 and by another 2.3% in 2023. The National Bank of Russia predicts negative growth of -8 to -10% in 2022, and 0 to -3% in 2023; the corresponding figures are -7.8% and -0.7% for the "central" scenario of the Ministry of Economic Development, for which the purchasing power of households could fall by almost 7% from 2022. For the record, GDP fell by 2% in 2015, following the invasion of Crimea in 2014 and subsequent Western sanctions.

So far, employment has been resilient to the downturn, partly due to temporary job retention agreements (or constraints), part-time work and other imposed leaves. However, this situation is not sustainable and companies will end up laying off workers, especially as bottlenecks in industry are expected to increase in the coming months as inventories of intermediate products run out.

The gradual deterioration of public finances, as well as the need to recapitalise some companies, particularly in the banking sector, could force the government to resort to borrowing. In the absence of access to the Western capital market, it would have to borrow essentially on the domestic market, from banks or households to whom it would have to offer an interest rate higher than inflation, with side effects on productive investment already forecast to fall by nearly 20%. The alternative solution would be to monetise the deficits, i.e. to have them financed by the central bank, with a high risk of aggravating inflation and triggering a run on bank deposits.

Russia's impoverishment could be long-lasting

Europeans will gradually move away from their dependence on Russian hydrocarbons. Asia will unlikely make for the loss of European market. More importantly, the transition to renewable energies could gradually reduce global demand and prices of hydrocarbons.

The withdrawal of Western multinationals from the Russian market and the cessation of deliveries of essential inputs to key industries such as automotive, aeronautics or IT services also signal a lasting slump in the Russian economy. According to Simola (2022a), the food import substitution strategy put in place in 2014 (in reaction to the embargo on Western exports in this sector) has not been a success: while local production has been able to substitute for imports in the area of poultry or pork, the overall effect has been a rise in consumer prices. In the field of high technology, substitution could be even more difficult. In some sectors such as electronics, transport equipment, pharmaceuticals or machine tools, the share of foreign inputs in the value produced is very high. China's share in total procurement increased by 2.5 percentage points between 2013 and 2018. However, its weight of 14% is still much lower than the combined share of "Western" countries, stable at 61%. Looking at the dynamics of Russian input imports since 2012, Simola concludes that there is limited potential for substitution, particularly in pharmaceuticals and transport equipment manufacturing.

So how can the impact of trade sanctions be assessed? Unsurprisingly, this topic is subject to the same methodological debates as for the European economies. Using international input-output tables representing value chains for 35 sectors, Simola (2022b) estimates the impact on Russia's GDP of a total halt in Russian exports and imports to/from "Western" countries (including Japan, Korea and Taiwan) at -12% and -10% respectively. In the case of complete decoupling, the impact would therefore be very significant, even if the two figures should probably not be added together insofar as the cessation of exports renders some imports useless. Using a general equilibrium model, thus taking into account substitutions and price adjustments, Felbermayr, Mahlkow and Sandkamp (2022) find that a quasi-complete decoupling would reduce the standard of living in Russia by about 10%. Langot et al (2022) obtain a similar order of magnitude using the model of Baqaee and Fahri (2021). However, these figures do not take into account the withdrawal of Western multinationals from Russia. Assuming that half of the subsidiaries' activity would be discontinued, Mahlstein et al (2022) estimate that this effect alone would decrease Russian GDP by 12%. Korhonen and Kortelainen (2022) obtain about -10% using the International Monetary Fund's integrated model, which incorporates confidence shocks, but without full trade decoupling.

From one disease to another

Over the past decades, researchers have regularly asked whether the Russian economy could be subject to the “Dutch disease.” This syndrome describes the difficulty of energy and commodity exporting countries to diversify their economies by developing manufacturing industry in particular. This is because the oil rent attracts the factors of production - labour and capital - and increases the costs for other activities which then struggle to emerge in the face of foreign competition. Only those sectors that are "sheltered" from foreign competition develop, mainly in services. The phenomenon can be reinforced if the government distributes the tax revenues linked to oil rents and, on the contrary, mitigated if, as is the case in Norway, the government accumulates the corresponding revenues in a sovereign fund instead of spending them. From 2008 onwards, Russia has saved part of its oil revenues in a fund, following different fiscal rules. However, the assets of the fund seem to have been severely devalued since the beginning of the war, not to mention the sanctions on the part invested abroad.

The programmed attrition of the energy rent will keep Russia away from the Dutch disease, even if it will leave it with other raw materials that will certainly be able to increase in value in the coming period: nickel, palladium, cereals... However, Russia will have to develop new economic activities and insert them into the global value chains. This will involve bringing back foreign investors rather than relying on import substitution, which does not seem to have worked well in the 2014-2021 period. Contrary to what the reputation of the Russian mathematics school might suggest, the education system does not seem to be performing particularly well when assessed by the PISA tests at age 15; Russia is ranked only 45th in the Global Innovation Index 2021, between India and Vietnam. It will be difficult to find a path to growth without reopening the country, attracting capital, technology, know-how and talent, especially as Russia's population could decline by 0.3% per year by 2030, according to the UN median scenario. The Covid pandemic and the war could accelerate the demographic decline: in 2021, the country lost more than one million inhabitants (about 0.7% of its population) due to more deaths than births, in relation with the pandemic; and even though it benefited from a positive net migratory inflow, Russia's total population fell by about 0.4% that year. The war could dry up or even reverse migrations.

***

Read more:

>> Version française : Le rouble qui cache la forêt

>> All posts by Agnès Bénassy-Quéré, chief economist - French Treasury