Trésor-Economics No. 150 - Economic sanctions: what have we learned from the recent and not so recent past?

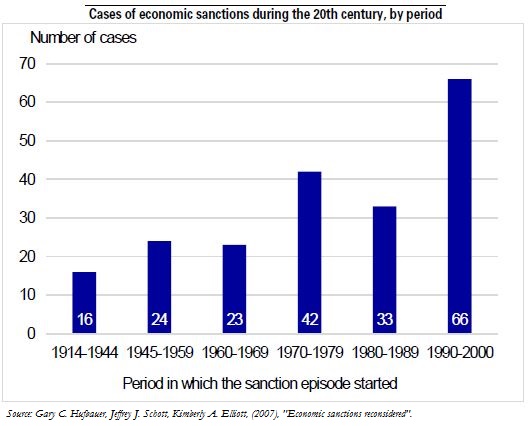

The use of economic sanctions as a tool for diplomacy is nothing new. The benchmark study by Hufbauer, Schott and Elliott published in 2007 inventories more than 200 sanctions episodes instituted since the beginning of the 20th century. More recent developments, such as the sanctions imposed against Russia or the upcoming lifting of sanctions against Iran, show that sanctions are still a very topical issue.

Empirical work on the success of economic sanctions is still equivocal: the unique characteristics of each sanctions episode, such as the types of measures implemented, the nature of the policy goal being sought, or the coalition of sender countries, make comparative analysis a very complex task.

Another factor complicating the task is the linkage between two separate goals that must be defined in each sanctions episode. These are the ultimate political goal and the intermediate economic goal sought to bring pressure to bear on the target country.

Therefore, the effectiveness of sanctions depends on a clearly defined intermediate economic goal that can actually bring about a change in a policy stance.

This issue of Trésor Economics uses an analysis of the microeconomic and macroeconomic mechanisms in play to propose a number of principles to improve the chances of success and thereby increase the effectiveness of sanctions, while minimising the economic costs for the sender countries. Ultimately, improving the effectiveness of sanctions enhances their credibility.