Common Ownership and Competition

The holding by the same investor of minority stakes in the share capital of several companies active, and possibly competing, on the same market has developed strongly in recent years. This is known as joint ownership and is linked to the development of institutional shareholding, which makes it possible to reduce the financing costs of companies, but could also, particularly in concentrated markets, generate anti-competitive effects.

Recent years have seen a rapid expansion in common ownership, which is where an investor holds minority shares in multiple firms operating, and potentially competing against each other, in the same market.

Common ownership is primarily a practice of institutional investors (banks and insurance companies, but also collective investment undertakings such as investment funds and pension funds), which hold shares on behalf of their clients and collect their voting rights.

The past two decades have seen a rise in institutional shareholding internationally, which has the effect of reducing research and analysis costs for investors and, ultimately, financing costs for firms.

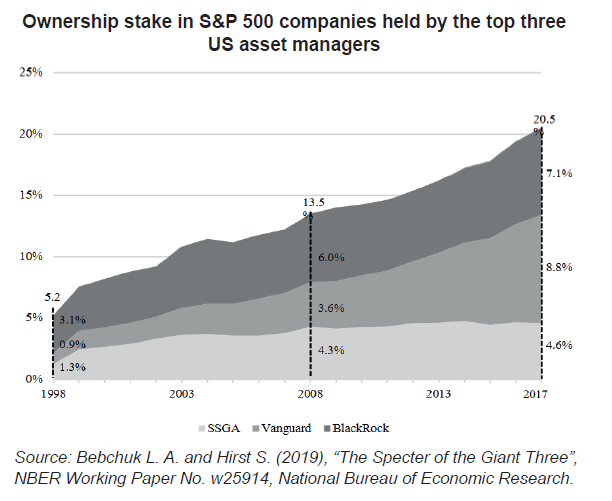

The expansion of institutional shareholding has led to an increased prevalence of common ownership in listed companies. In the United States, the average combined ownership stake in S&P 500 companies held by the three largest institutional investors grew from 5% in 1998 to roughly 20% in 2017 (see chart). With the rise in popularity of index funds, the ownership stake in US listed companies held by institutional investors with positions of 5% or more in other companies in the same industry grew from less than 10% in 1980 to nearly 60% in 2014. In Europe, in 2016, common ownership with at least 5% participation involved 67% of listed companies.

Common ownership may weaken competition in concentrated sectors, such as in the airline or pharmaceutical industries. However, there is a lack of consensus as to the overall economic impact of common ownership.