China's Position Among Lenders in Sub-Saharan Africa

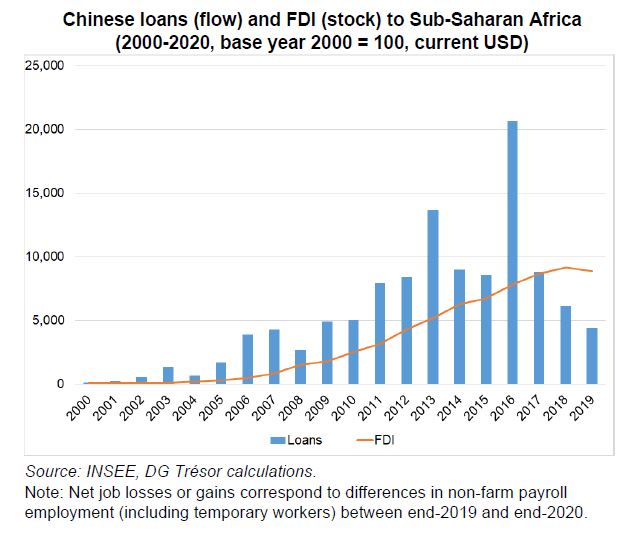

In 20 years, China has become Sub-Saharan Africa's largest creditor, holding 62.1% of its bilateral external debt in 2020, up from 3.1% in 2000. These loans are based on a complex institutional architecture, which favours tools derived from private loan contracts, securing both repayments and Chinese strategic interests. Since 2016, these flows have undergone a quantitative and geographical recalibration, which has been accompanied by a growth in Chinese FDI.

Over the past two decades, China has become the leading lender in sub-Saharan Africa, holding 62.1% of the region's bilateral external debt in 2020, up from 3.1% in 2000. Its loans are mostly split between seven countries, which account for two-thirds of Chinese lending over the period.

The growing proportion of Chinese loans compared to other lenders is based on a complex institutional framework, in which two State-owned "policy banks" – the Export-Import Bank of China (56.8% of loans) and the China Development Bank (22.9%) – play a central role.

Chinese loan contracts contain a large number of specific clauses. Chinese banks seem to prefer the mechanisms of private loan contracts, securing both their repayments and their strategic interests with cross-default clauses that allow the lender to terminate the loan and demand repayment if the borrower defaults on its other creditors. They also use "tied aid" mechanisms, more or less requiring countries to use Chinese contractors.

The dependence of some African countries on Chinese lending has consequences not only for the debtor countries themselves but also for multilateral debt treatment arrangements.

Since 2016, Chinese lending to Sub-Saharan Africa has been undergoing a shift in terms of geography and lending volumes in an effort to secure Chinese loans on the continent. The relative decline in Chinese lending has been accompanied by an increase in foreign direct investment (FDI) and a growing role in standard-setting (see chart opposite).