Development finance in Sub-Saharan Africa in the times of Covid-19

Achieving sustainable development goals by 2030 requires a significant increase in development financing, which has been made even more difficult by the global health crisis related to COVID-19. This note assesses the impact of the COVID-19 crisis on private capital flows in sub-Saharan Africa and examines options for long-term development financing in the post-COVID-19 period in the countries concerned.

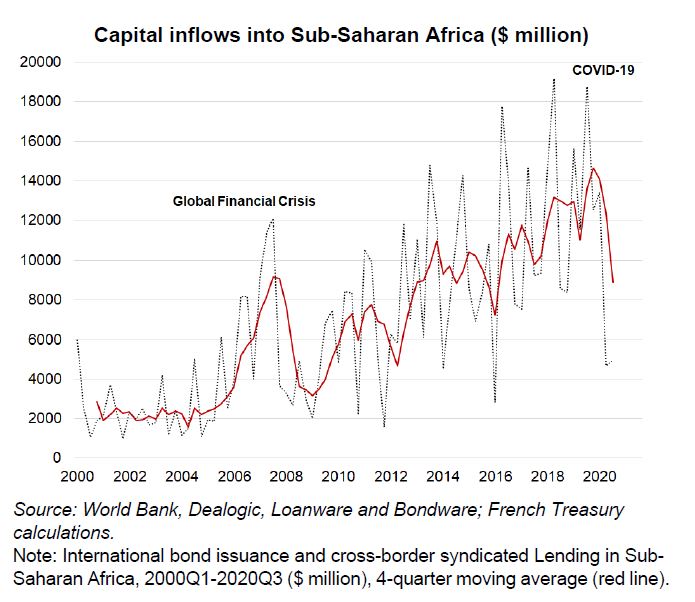

Meeting the 2030 Sustainable Development Goals requires a significant scale-up in development finance, particularly in Sub-Saharan Africa (SSA). The COVID-19 global health crisis has made this even more difficult since it triggered unprecedented capital outflows from emerging markets and developing economies (EMDE), including in Africa where it amounted to $95bn in March. The pandemic has further amplified concerns about fiscal and debt sustainability in SSA, and some heavily indebted countries are experiencing financial difficulties. The International Monetary Fund (IMF) estimates that Sub-Saharan Africa could face a financing gap of $290bn between 2020 and 2023 (i.e. 16% of SSA's GDP in 2019).

Financing the long-term recovery in the wake of COVID-19 and re-launching countries on a path towards sustainable and inclusive growth requires significant efforts. These include: domestic reforms to enhance sustainable growth and domestic revenue mobilisation; attracting and crowding-in the private capital flows; and stepping up official financial flows.

The global pandemic however also offers some important lessons for development finance, particularly as regards to new technologies and financial innovation. During the crisis, countries with digital, contact-less processes and procedures have fared better in terms of tax collection and business continuity; a move to accelerate digital transformation in tax administration would thus help mobilise domestic revenue more generally.

The demand for COVID-19 bonds, issued by multilateral development banks to raise funds for vulnerable health systems and critical infrastructure, underscores the growing importance of a socially conscious, impact-oriented investor base which could be leveraged post crisis to finance the SDGs. With the right governance framework, private equity, pension and sovereign wealth funds could play a greater role in financing development.