Services in French foreign trade

Since the early 2000s, services have accounted for a growing share of France's trade, making it one of the world's leading exporters of services. This trade is based on historical strengths, such as tourism, but it is business services that are the main driving force behind it. While trade in goods has been in deficit since 2004, trade in services has been in surplus and is helping to rebalance the current account.

France is one of the world's leading exporters of services, ranking fourth in the world behind the United States, the United Kingdom and Germany, whereas it is in sixth place in terms of goods. It accounts for 5% of world exports of services, compared to 3% for goods.

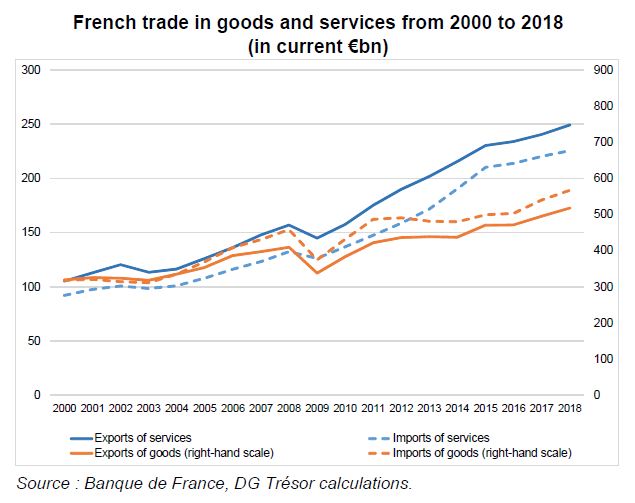

The share of services in French trade has risen from 24% in 2000 to more than 30% today (see chart on this page). This has primarily been due to an upswing in business services, reflecting the growing internationalisation of French production. Conversely, the share of travel (including spending by tourists), historically the driver of France's services exports, has fallen off (from 27% of services exports in 2010 to 22% in 2019).

The balance of services, which has historically been in surplus, has seen that surplus nearly double between 2000 and 2019 (€13.1bn in 2000, €21.6bn in 2019, as reported in the balance of payments). It partly compensates for the goods trade deficit (–€46.8bn) and helps to redress the current account balance.

As with goods, the European Union is the principal zone of origin and destination for French services, with 44% of exports and 54% of imports. Exports to Asia and America during the 2010s were particularly buoyant, while trade with Africa, both for imports and exports, is growing less rapidly than with other regions of the world.

The United States is France's leading destination market for French services, while Germany is France's main service provider.