Trésor-Economics No. 236 - An overview of minimum wages in advanced economies

Most major advanced economies have a minimum wage. In Germany, Spain and the United Kingdom, there is a single national minimum wage, as in France.

Most major advanced economies have a minimum wage. In Germany, Spain and the United Kingdom, there is a single national minimum wage, as in France. In Japan and the United States, minimum thresholds are set at local level. In Italy, there is no legal minimum wage. In addition, there are differences in the minimum wage's characteristics and how it is determined. The age at which the minimum wage is mandatory varies from 16 in Spain to 25 in the United Kingdom. Rules for adjusting the minimum wage also differ: a number of countries increase their minimum wage yearly, in Germany increases are decided every two years, while in the United States they are much less frequent because there is no set rule (the last increase in the federal minimum wage took effect in 2009).

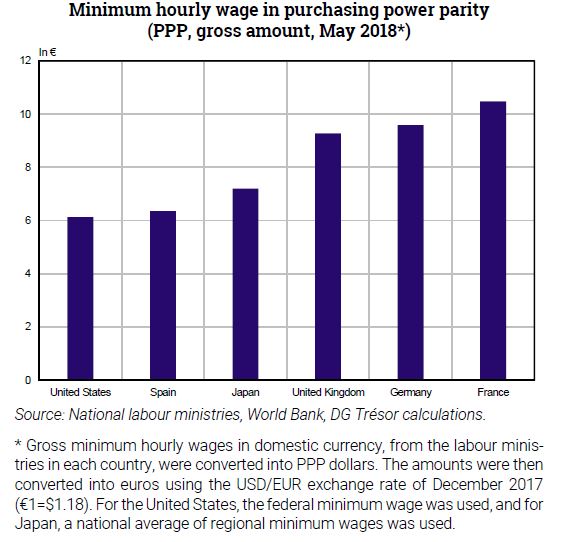

Compared to the major advanced economies, the French minimum hourly wage has remained at a relatively high level since 2000 (see chart). However, various measures targeting low wages (general tax relief, the Competitiveness and Employment Tax Credit, the Responsibility and Solidarity Pact) have reduced the cost to employers.

International studies show that the macroeconomic effects of the minimum wage on total employment vary from one country to another, but are negative with regard to youth employment. The effects of changes to the minimum wage depend on its initial level: if it is low, an increase is likely to increase employment, but if it is already high, an increase reduces employment.

The effects of an increase in the minimum wage on productivity depend on the context. By motivating employees or encouraging training, it can drive productivity gains. However, these effects depend very much on the quality and access to vocational training facilities.

Finally, the minimum wage has contributed to the reduction of wage inequality in advanced economies, but is not the best tool for tackling inequality or poverty. Tax policies and social transfers seem better suited to this objective than raising the minimum wage.