Trésor-Economics No. 234 - The change in the labour share in value added in advanced economies

Analysis of how the value added is shared between production factors provides insight into trends in inequalities and private consumption. The division reflects both relative changes in the volumes of capital and labour, and the relative trends in compensation per unit of capital and labour. "Distributable surplus" is a helpful concept for studying the division of value added; it is the share of real GDP growth–arising primarily from productivity gains–available to improve unit (hourly) compensation of labour, and unit compensation of capital.

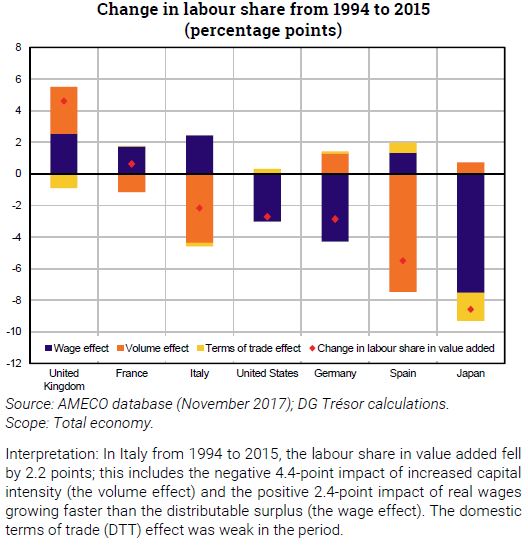

Since the 1990s, the labour share in value added has declined in most leading OECD countries, generally to the benefit of higher profit margins, except in France where the labour share has been broadly stable, and the United Kingdom where it has increased. In countries where the labour share has fallen, the decline is attributable to two effects, namely increased capital intensity and low growth in real wages. The magnitude of these effects differs across countries; increased capital intensity is particularly pronounced post-financial crisis in Italy and Spain, whereas low real wage growth has had a greater effect in Germany, the United States and Japan.

In the long run, on average, the distributable surplus is allocated essentially to raising real wages. The observed slowdown in real wages is accordingly due in part to slower productivity gains in most of the large advanced economies, reducing the distributable surplus and therefore the rate of growth of real hourly wages. However, since the mid-1990s, part of the distributable surplus has also gone to the remuneration of capital in Germany, the United States and Japan, rather than to increasing workers’ hourly compensation. This has not been the case in France, where the entire surplus has gone to workers’ hourly compensation.

The decline of the labour share in value added may have multiple causes. Technical progress may induce substitution of capital for labour. Increasing exposure to trade and international competition may encourage the relocation of labour-intensive stages of production processes; it may also lead to a reduction in employees' bargaining power, thereby exerting downward pressure on wages. Further, in some countries, a rise in firms' market power may have dampened the trend in real wages.