Trésor-Economics No. 233 - Relation between inflation and the cycle in the past five years

The business cycle has a significant effect on inflation, known as the Phillips effect: growth 1 point higher than its potential in a given year increases next-year inflation by 0.3 point. The correlation between inflation and the economy's position in the business cycle weakened in the 1970s and 1980s, but does not appear to have declined further in the past 15 years.

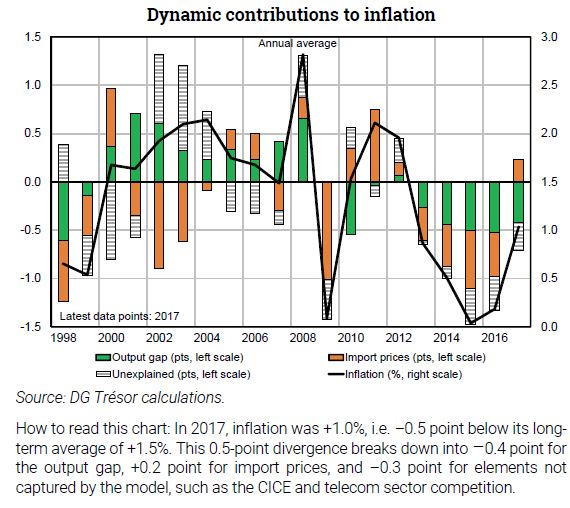

In the past few years, French inflation has surprised some observers on the downside. Inflation was +0.2% in 2016 and +1.0% in 2017, after declining for four years in a row, from +2.0% in 2012 to 0.0% in 2015. Over the same period, the French economy performed significantly below its potential, by about 1.5 points on average between 2013 and 2016.

Inflation weakness between 2013 and 2016 reflects the extended period of low economic growth and the decline in oil prices. Over 2013-2016, on average, weak economic activity had an estimated –0.5-point p.a. impact on inflation. The downtrend in oil prices over the period weighed on the consumer price index and had a comparable effect on inflation (–0.5 point). Lastly, measures to reduce labour costs (Competitiveness and Employment Tax Credit – CICE, and the Responsibility and Solidarity Pact), along with stiffer competition in the telecoms sector, have dampened the inflation rate further over the last few years.

This recent period of sluggish inflation is expected to end gradually, reflecting–with a certain lag–the ongoing closing of the output gap. Thus, core inflation (i.e. excluding its most volatile components such as energy and food) is expected to rise steadily to +0.9% in 2018 and +1.1% in 2019, vs. +0.4% in 2017, at a pace consistent with the projected closing of the output gap.

The modest level of inflation suggests that the output gap was still negative in 2017 despite economic surveys indicating pressure on the production system.