Trésor-Economics No. 231 - The global network of central bank swap lines

Bilateral swap lines are ex-ante arrangements between central banks that provide protection from foreign currency liquidity risk. These lines are not subject to conditionality, and foreign central banks can draw on them under predefined terms. From an economic standpoint, the transaction can be likened to a foreign currency loan, backed by local currency collateral, with the borrower bearing the foreign exchange risk.

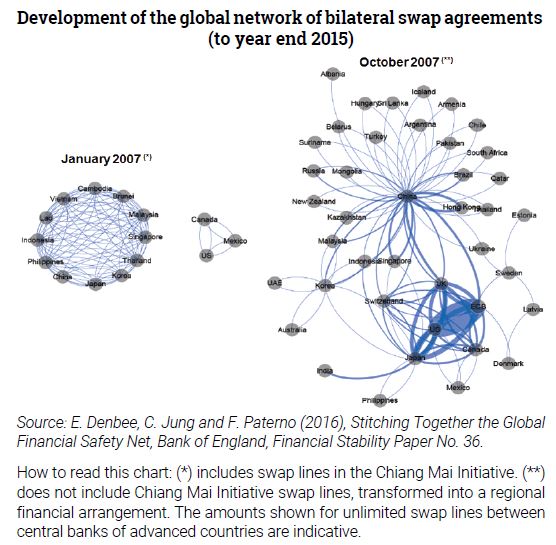

During the 2008 financial crisis, the US Federal Reserve authorised temporary swap lines with 14 central banks of advanced and emerging countries. This was an urgent response to US dollar liquidity shortages that had appeared since August 2007, and was intended to avoid negative effects for the global economy and the United States. On 10 December 2008, the Fed's lending to other central banks via swap lines peaked at USD580bn, equal to almost one-quarter of total Fed assets and to 168% of the IMF's balance sheet at the time. This swap line programme was effective in restoring liquidity on the markets and was terminated in February 2010.

In May 2010, fresh strains on short-term dollar funding markets prompted the Fed to reopen unlimited swap lines with five other central banks. These lines were converted into standing arrangements in late October 2013. In the absence of conditionality, a swap agreement requires mutual trust between the parties. Contrary to institutions such as the IMF, it does not rely on a multilateral agreement. In reality, the Fed authorised such agreements with major advanced economies only.

In parallel, the People's Bank of China (PBoC) has set up renminbi (RMB) swap agreements. In just a few years, it has created a large network and become a leader in the international network of swap lines, with 33 agreements totalling USD460bn in 2017 (vs. USD25bn in 2008), mostly with central banks in emerging or developing countries.

Thanks to these initiatives, China can aim to expand the RMB's role as an international currency even though its capital account is partially closed, thus widening its influence. In addition, the agreements that China signs with sometimes weak countries have less stringent apparent conditionality and less rigorous selectivity criteria than other forms of multilateral or bilateral aid. Thus, China is building its influence by competing with international institutions – but at the risk of undermining financial stability.