Trésor-Economics No. 225 - Is the productivity slowdown in emerging countries here to stay?

Growth in emerging countries has been on the decline since 2010, with average annual rates of 5.0% between 2011 and 2016, after 6.6% between 2000 and 2007. This slowdown, common to all emerging regions, is more marked in Latin America and Asia.

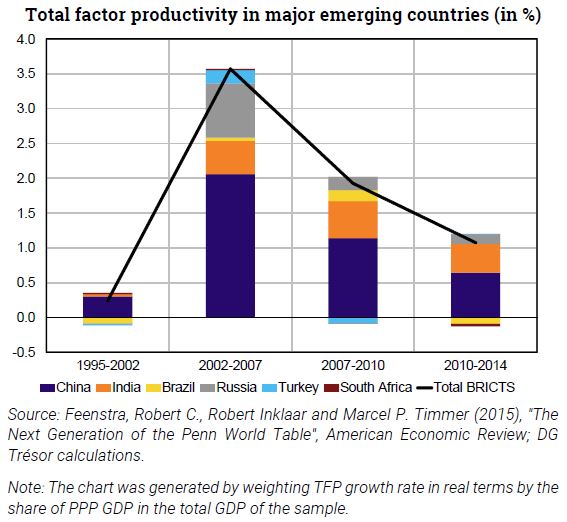

A fall-off in total factor productivity (TFP) growth explains a large part of the decline in growth in these countries. This slowdown came after a rapid technological, commercial and educational catch-up in the 2000s. Since the 2008 crisis, a significant slowdown in TFP has been observed in most major emerging countries.

The slowdown in productivity gains and growth in general is a global phenomenon, which is part of the broader debate on "secular stagnation" and possible diminishing returns from innovation. In emerging markets, the slowdown in TFP comes partly from sources common to emerging and advanced economies, such as the legacy of the crisis and the slowdown in world trade, which, due to less dynamic diffusion of technology and less competition, is slowing productivity gains.

In addition to common factors, there are structural phenomena that are specific to emerging economies. Some countries such as China have seen a decline in internal migration (which supports productivity by promoting the reallocation of production factors), thus slowing the associated productivity gains. Moreover, reform momentum, particularly in China and India, appears to be weaker than in the 1980s and 1990s. Finally, poor allocation of production factors and an unfavourable institutional environment hamper productivity.

Some economists believe there is a "middle-income trap", where countries too rich to benefit from low-cost labour but not rich enough to compete with advanced countries on high-end products, are stuck. The existence of such a trap is debatable, with a few countries, such as South Korea, having managed to converge towards advanced countries in recent decades.