Trésor-Economics No. 223 - What do business surveys tell us about the position of the economy in the business cycle?

Knowing the position of the economy in the business cycle is important for implementing economic policy. It makes it possible, for example, to draw up a medium-term growth scenario: an overheating economy is likely to slow down whereas a demand deficient economy could beat its potential growth rate. Similarly, it makes it possible to identify the structural component of the general government balance and the efforts needed to achieve structural fiscal balance.

The position of the economy in the business cycle is often identified by the output gap, which cannot be measured with certainty. The output gap tracks the surplus or lack of demand, relative to the economy's potential output.

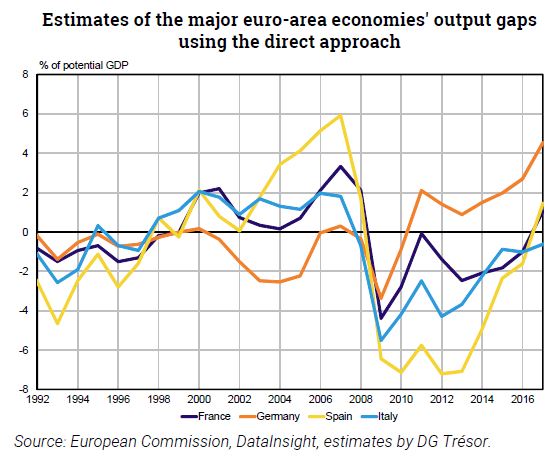

Estimates by international organisations showed that the output gap remained negative on average in the leading European economies in 2017, but to varying degrees. This seems consistent with the lack of inflationary pressures, but is difficult to reconcile with the production capacity constraints that some major European economies have experienced.

This paper presents an approach that is complementary to the ones international organisations use to estimate the output gap, and which relies solely on survey data about production capacity constraints. The findings of this "direct" approach are less likely to be revised than the results of more conventional methods. Therefore, these findings may supplement those of the standard analysis and provide real-time information about the position of the economy in the business cycle.

However, this complementary approach does not account for structural factors, such as changes in prices, wages or unemployment rates, which are used by the standard approaches to assess how fully factors of production are utilized. Furthermore, the direct approach cannot help to interpret the past potential growth path, nor forecast a medium-term one. This makes interpreting the output gap level a delicate exercise.

If we are to believe the indicators showing increasing pressure on production capacity in Germany and France, and, to a lesser degree, in Spain, these economies are further along in the business cycle than the international organisations' estimates seem to show.

This method is not intended to replace the existing methods, but to provide a broader range of tools for tracking phases in the business cycle. It could be used as a robustness check of standard estimates and to enhance short-term economic analysis.