Trésor-Economics No. 220 - Is higher wage growth on the horizon in Japan?

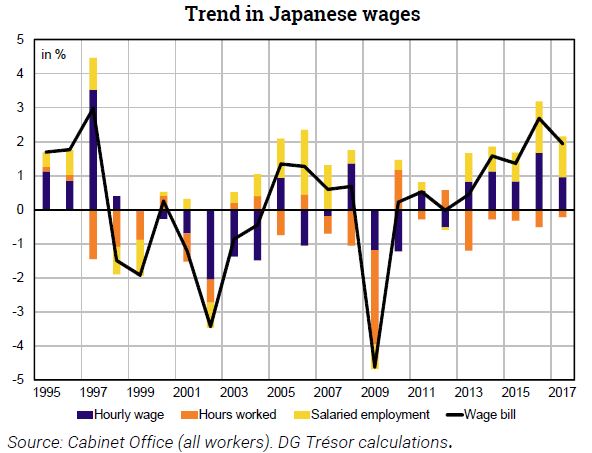

After the 1997 economic crisis, Japanese companies were burdened by high levels of debt. They attempted to deleverage by lowering their wage bill, through both job cuts and wage restraint. Japan's unemployment rate, which had been below 3.5% until 1997, then rose significantly to peak at 5.5% in June 2002. Average per capita wages declined by 0.7% p.a. between 1998 and 2013, keeping Japan in deflation in the 2000s.

The development of more flexible forms of work (short-term contracts, part-time jobs, etc.) contributed to the wage restraint; such jobs are generally paid less, putting a damper on average per capita wages. The pay of full-time employees also declined - its variable part, in particular, with fixed pay following suit later on.

Until 2012, the wage slowdown was fuelled by the fact that the Bank of Japan (BoJ) had no explicit inflation target to anchor expectations. As a result, wage negotiations focused strongly on past inflation. Thus, between 2002 and 2013, wage negotiations resulted in a reduction in the fixed portion of full-time employees' total pay.

A first turning point came in late 2012, after the newly-elected Abe government implemented "Abenomics", its highly accommodative economic policy. Hourly wages have returned to a positive trend since 2013, and average per capita wages since 2014. Nevertheless, the wage trend since 2013 has not been strong enough to bring inflation up to the 2% target set by the BoJ in 2013.

However, wages could accelerate further by 2020 thanks to improvements along the economic cycle, strong pressures in the employment market (accentuated by a shrinking population) and tax incentives for raising wages. This wage acceleration could, in turn, buoy inflation.