Trésor-Economics No. 206 - Potential growth in France

Economic assessment often relies on the estimates of potential growth and the output gap, an indicator which describes the position of the economy in the cycle. As these notions allow for the breakdown the general government balance into its structural and cyclical components, they also have a strong bearing on the steering of public finances.

The uncertainty surrounding estimates of these concepts makes it difficult to use them to guide economic policy. For instance, in 2007, most analysts considered the output gap to be slightly negative, whereas now, with hindsight, it is thought that it was highly positive at the time and, therefore, that the economic cycle was at a peak.

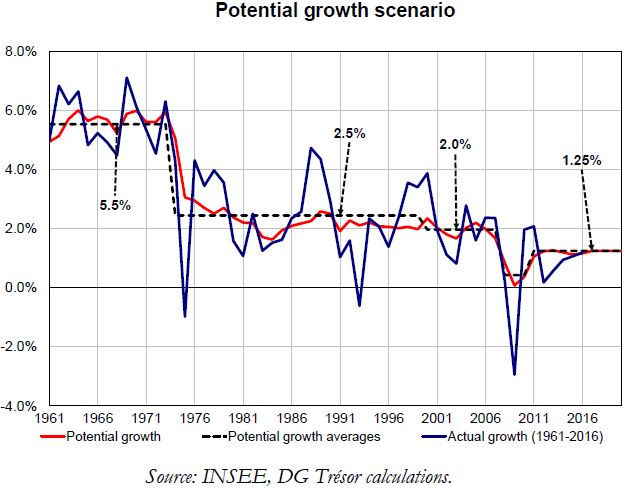

Whilst prior to the 2008 crisis, the French economy’s potential growth rate was around 2%, it is expected to be in the order of 1¼% between 2017 and 2020. The main reasons for this slowdown are the lower growth rate of total factor productivity (TFP) and a smaller contribution of capital. The slowdown in TFP is common to all advanced economies and may reflect both a general trend towards slower technological progress and the long-term fallout from the 2008 crisis.

It is estimated that the output gap was approximately −1½% in 2016. This implies that the French economy could experience a temporary recovery during which actual growth may outstrip potential growth.

Public policies may have a positive impact on potential growth by reducing structural unemployment and boosting productivity and investment. This is the case for labour market and training reforms, or support for innovation.

This scenario is close to that of the international organisations, in particular the European Commission. It is similar to those of the IMF and OECD – even though these organisations consider that the output gap was wider in 2016.