Trésor-Economics No. 209 - How to explain Germany's strong current account surplus?

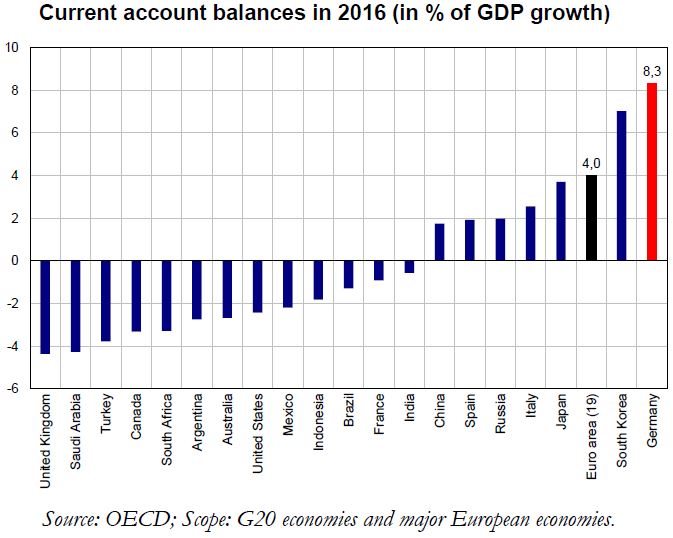

Germany's current account – the difference between domestic saving and investment – was slightly in deficit in 2000. By 2016, it totalled an unprecedented €261bn, or more than 8% of the country's GDP.

Wage moderation during the 2000s accounts for up to a third of this surplus. Slower increases in German wages relative to those in the euro area improved Germany's competitiveness within the single currency zone and led to higher exports, whereas low wages dampened both consumption and imports.

Germany's ageing population – the country's birth rate has been declining since the end of the Second World War – could account for another third of the current account surplus. German baby boomers are now nearing retirement and are saving in anticipation. At the same time, sluggish population growth weighs on investment due to the expected slowdown in growth over the long term.

The remaining third of the country's surplus reflects other factors, first among them being a tighter fiscal policy than its neighbours’.

A number of observers have found Germany's current account surplus to be excessive in light of the country's economic fundamentals. This partly reflects a price misalignment between Germany and the rest of the euro area, which should be reduced inasmuch as it goes hand-in-hand with an uneven distribution of activity between euro area countries: excess activity in Germany to the detriment of activity elsewhere.

To help rebalance current accounts across the euro area, Germany could boost wages and stimulate domestic demand, which would lower its surplus and increase euro-area inflation, at a time of constrained monetary policy. At the same time, other euro area countries should continue their fiscal consolidation efforts and keep wage increases in chec.