Trésor-Economics No. 188 - Unemployment benefits in France compared to European practices

Unemployment insurance is not necessarily the only protection against involuntary loss of employment. Indeed, in many European countries, unemployment benefits are only part of the replacement income for the jobseekers. These benefits may be supplemented with other social transfers, such as housing benefits and family allowance, and/or specific tax reductions.

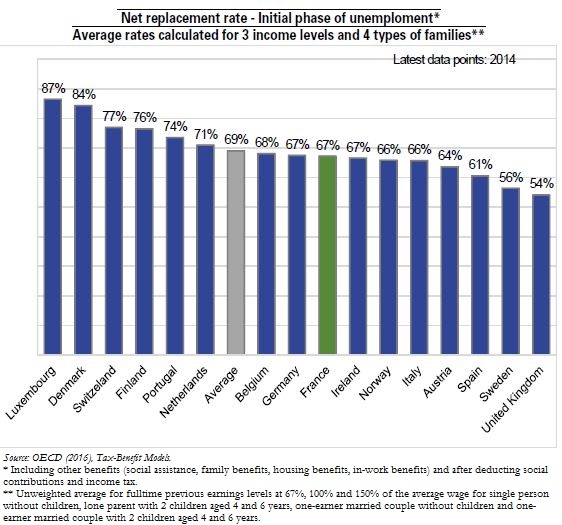

Cross-country comparisons of public financial support arrangements for the jobseekers require to grasp and evaluate the system as a whole and all its parameters: replacement rate of previous in-work earnings, benefit duration, eligibility criteria, consideration of family situation, other welfare benefits and any obligations incumbent on jobseekers. Comparative analysis of net replacement rates for claimants, which include all welfare benefits, shows that, on average, France is in line with European practices (see chart below).

On the other hand, France stands out because of the preponderance of unemployment insurance benefits in the jobseekers’ income, stemming from the virtual absence of any other specific social transfers to the unemployed. Unlike other countries, the claimant's family situation has little effect on the initial net replacement rate.

The preponderant share of unemployment insurance benefit in replacement income goes along with very generous eligibility criteria (4 months of employment during a 28-month reference period) and with longer benefit duration compared to European practices, particularly for older claimants (24 months for the standard benefit and 36 months for claimants over the age of 50). Furthermore, France stands out for its very high maximum benefit level. France has the highest net replacement rate for high earners who lose their jobs.

The specific terms for accumulating unemployment insurance entitlements and combining work income with unemployment insurance benefits also have some effect on incentives to return to employment, as stressed in a study by France's Council of Economic Analysis (CAE).

Job search incentives also depend on the obligations incumbent on jobseekers and on the penalties incurred in the event of default. In this respect, France seems to have fairly lenient requirements for claimants.