Trésor-Economics No. 178 - The October 2015 agreement on France's complementary pension schemes for private-sector employees (AGIRC and ARRCO)

France has two points-based pay-as-you-go compulsory complementary pension schemes for private-sector employees: AGIRC covers managerial and executive staff (cadres), and ARRCO covers non-executives (non-cadres). The schemes were established in the second half of the twentieth century and are managed directly by the social partners (trade unions and employer organisations).

Without adjustments, both schemes faced the risk of exhausting their financial reserves: according to a 2014 report by the French Supreme Audit Institution (Cour des comptes), this could have occurred in 2018 for AGIRC and 2027 for ARRCO. In response, the social partners agreed on 30 October 2015 to a series of measures relating to: (i) the amounts of pension benefits paid to retirees, (ii) retirement age, with incentives to postpone retirement, (iii) governance, with the merger of the executive and non-executive schemes, and (iv) social contributions.

- The measures concerning the amounts of pension benefits are being implemented from 2016 to 2018; part of the adjustment affects current pension recipients by restricting nominal increases in existing pensions, and part will affect future pensioners by making the pensions system less generous in the long run.

- Incentives to remain in employment ("solidarity coefficients" and "increase coefficients") should raise the effective retirement age and maintain around 100,000 additional persons in the labour force in 2025, thus raising the amount of contributions.

- Merging the AGIRC (executive) and ARRCO (non-executive) schemes in 2019 will simplify the pension system and reduce administrative costs.

- In the new unified scheme, the contribution assessment base will be broadened and certain contribution rates will be increased.

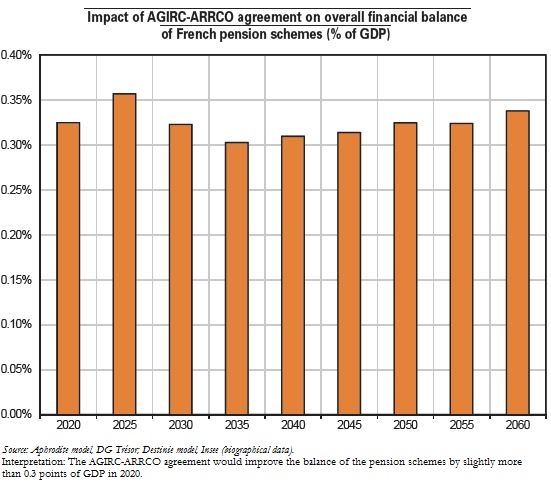

The combination of these measures improves the balance of the entire pension system by 0.3 points of GDP starting in 2020 (see Chart on this page), according to DG Trésor projections made using the Aphrodite pension dynamic microsimulation model. The improvement continues through the 2060 projection horizon. The assessment presented here is broadly consistent with the estimate at the 2030 horizon set out in the text of the agreement between the social partners.