Trésor-Economics No. 176 - How would the external debt of five major emerging countries respond to financial tensions?

The highly accommodative monetary policy implemented in the developed countries since the 2008 financial crisis has helped to stimulate large capital inflows into the emerging economies by investors seeking higher yields. These flows were reversed when the U.S. Federal Reserve raised interest rates and some emerging economies began to slow.

The emerging countries seem to have become less vulnerable to abrupt reversals of capital flows since the 1990s for reasons that include growth in domestic savings and foreign-exchange reserves, as well as greater exchange-rate flexibility. However, other weaknesses have developed, such as closer financial integration, a rise in private debt and a recent increase in foreign-currency debt for many emerging economies.

This study quantifies the vulnerability of external debt in a sample of five major emerging economies: Brazil, India, Indonesia, South Africa and Turkey. These countries have in common a large current-account deficit, heavy dependence on foreign investment and a structurally negative net external position. Our methodology enhances the IMF's framework for analysing external debt sustainability over the 2020 horizon in the specific case of our sample. Our contributions include (i) jointly simulated shocks on a larger set of variables to better reflect the correlation between past shocks, and (ii) shocks calibrated on recent observations to better capture the changing resilience of the sampled economies.

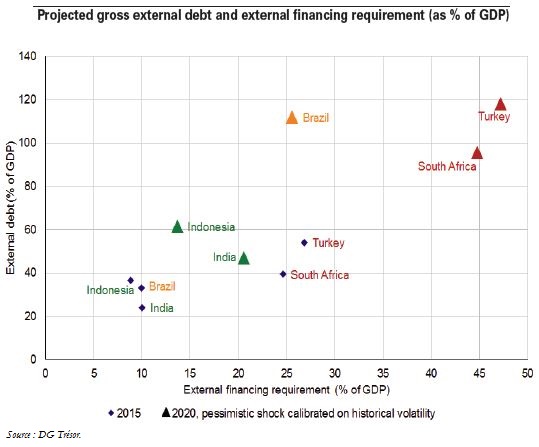

South Africa and Turkey seem the most vulnerable of the five countries studied if financial tensions should flare up again. In the worst-case scenario, a conjunction of negative shocks would nearly double their external debt and external financing requirement. Moreover, these countries are characterised by comparatively modest foreign-exchange reserves, a relatively short maturity of their external debt and, for Turkey, heavy foreign-currency debt. Low commodity prices increase South Africa's external financing requirement but reduce Turkey's.

Indonesia and India are moderately vulnerable. In the worst-case scenario, these countries would maintain a reasonable external debt and financing requirement. They have displayed good resilience in the recent and more distant past, and their central banks still have substantial manoeuvring room. India stands out favourably with a relatively low external debt and upward-revised forecasts for GDP and the current-account balance.

Brazil is in an intermediate position. Its current difficulties (recession, political uncertainty, declining commodity prices) aggravate the external risk, but the economy exhibits strengths that reduce short-term vulnerability (moderate external debt, long maturity, resilient foreign direct investment).