Trésor-Economics No. 175 - Policies to support personal and household services

The personal and household services sector meet specific needs at different points in the human life cycle (early childhood, old age, etc.) in a context of changing lifestyles, brought about in part by women's increasing participation in the labour force. The services include both care services (for children, the dependent elderly or the disabled) and non-care services or household support services (such as cleaning, ironing, gardening and minor home repairs).

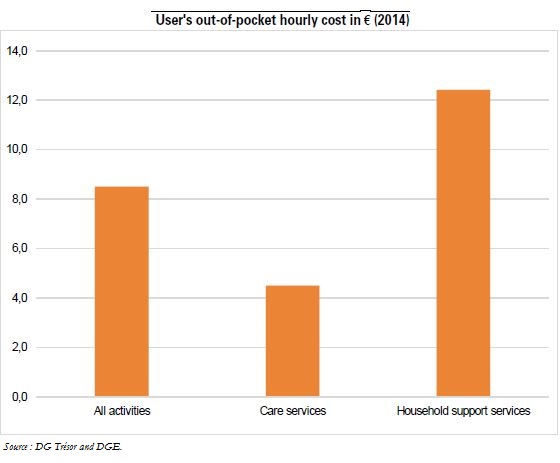

Government support for this sector is being driven (i) by policies to promote economic development and jobs, which set out( to make the cost of household support services comparable to the cost of undeclared labour and (ii) by a social justice objective, which is to ensure universal access to care services, regardless of income.

This support is made up of some fifteen measures that are directed at both the supply (social contribution exemptions) and demand (tax benefits and direct subsidies). These measures are specific, but, in practice, they are interlinked as they all help to reduce the price paid by the user. Nevertheless, simplifying and stabilising the social and tax framework would foster the development of this sector.

The total tax expenditures and social contribution exemptions to promote this sector were assessed at some €6.4bn in 2014. When the direct subsidies, partly paid by local governments, and general policy measures to reduce the cost of labour are included, the gross cost of government policies for personal and household services rises to slightly below €11.5bn.

A financial analysis ascertains the fiscal impact of greater use of personal and household service schemes if public support remains at the same level. The findings show contrasting situations, depending on the services concerned. In particular, greater use of household support service schemes, with simplified payment procedures, would not have a significant short-term fiscal impact. This is not the case, however, for care service schemes. This fiscal impact of this sector of services was a deficit of approximately €2.8bn in 2014.