Trésor-Economics No. 169 - Potential growth in the United States: is the weakness here to stay?

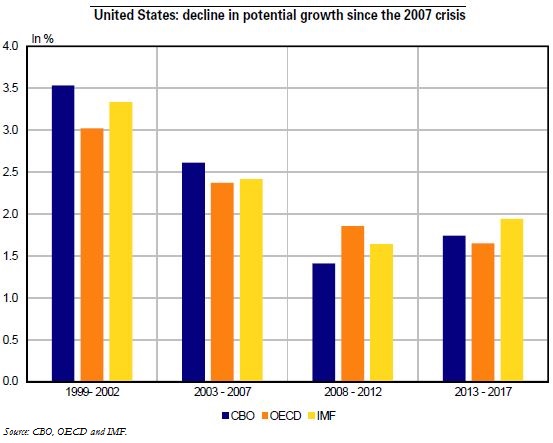

In the United States, the financial crisis accelerated the decline in potential growth by about 0.7 points compared with 2003-2007. Most organisations estimate U.S. potential growth at 1.5-2.0% in 2016, down from a pre-crisis average of 2.5%.

Approximately 40% of the observed decline in potential growth seems due to a lesser accumulation of capital stock. The sharp downturn in investment during the crisis and its relative weakness in the subsequent recovery have slowed capital accumulation. This impact needs to be put in perspective, however, given the recent investment rebound: the contribution of capital to potential growth should therefore return to–or even exceed–its pre-crisis level by 2016.

Overall, the labour factor accounts for an estimated 35% or so of the decline in potential growth. The latter had begun to weaken before the crisis because of the slower increase in the working-age population-compounded by a drop in the participation rate. Studies also show that natural unemployment rose during the crisis then declined again. It should not hamper potential growth in the years ahead.

Lastly, total factor productivity (TFP) appears to explain 25% of the slowdown in potential GDP growth during the crisis. The post-crisis TFP trend points to a sluggish recovery in productivity gains. Despite their recent acceleration, they are likely to remain weaker than the gains of the 1990s. Broadly speaking, TFP projections differ: some analysts argue that post-crisis trends will reflect the slacker growth observed since the 1970s, putting TFP growth at around 1.0%; other, more optimistic scenarios see a more vigorous recovery, consistent with the expected effects of the revolution in new information technologies, resulting in TFP growth of 1.7%.

Some of the reforms currently being considered in the U.S. target labour supply with a view to curbing the decline in the labour force. Others aim to support innovation in order to promote productivity gains. The Administration's recent reform proposals focus on family policy (introduction of paid maternity leave and tax credits to facilitate access to childcare services), education (free tuition for community colleges), immigration and making R&D tax credits permanent. The current political context in Congress, however, limits the prospects for such reforms.