Trésor-Economics No. 167 - The world economy in spring 2016: a gradual recovery after the 2015 trough

In 2015, the world economy lost momentum. There were, however, strong geographic disparities. The advanced economies continued to expand, with the United States and United Kingdom posting a brisk performance. In the emerging economies, by contrast, the slowdown persisted. World activity is expected to recover by 2016 and accelerate in 2017, driven by the rebound of the emerging economies-after five consecutive years of deceleration–and by faster growth in the advanced economies in 2016, which will be followed by stabilisation in 2017.

The emerging economies proved sluggish in 2015. The slowdown continued in China, while Brazil and Russia experienced deep recessions. On the positive side, India and, to a lesser extent, Turkey posted resilient growth. The emerging economies are forecast to accelerate gradually in 2016 and 2017, with improvements in Brazil and Russia more than offsetting China's persistent slowdown.

After their buoyant 2015 performance fuelled by strong domestic demand, the U.S. and the U.K. economies are likely to maintain their pace–perhaps with a mild deceleration over the forecasting horizon–while growing at above their potential rate. In Japan, the recovery begun in 2015, which proved fitful particularly at year-end, should last into 2016. However, the rise in value added tax (VAT) scheduled for 1 April 2017 may cause the economy to stall next year.

In the euro area, the recovery gained strength in 2015 but remained uneven. The sharp decline in interest rates, promoted by the European Central Bank's monetary policy, as well as a milder fiscal consolidation and low oil prices should provide continued support for growth over the forecasting horizon.

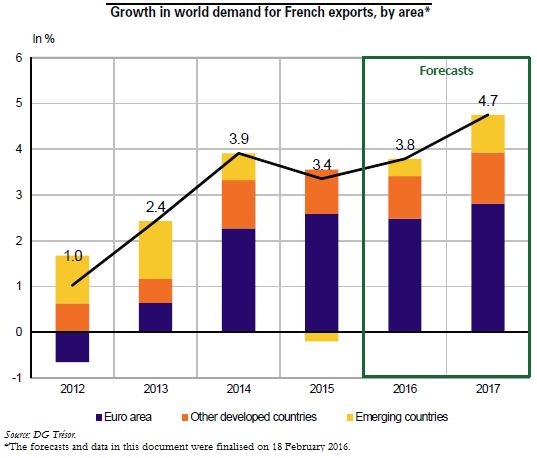

Real world trade slowed significantly in 2015, hampered by the contraction of imports by Russia, Brazil, China and other countries. World trade is expected to accelerate in 2016 and 2017, thanks to the gradual improvement in the emerging economies. Given France's trade structure, world demand for French exports suffered less from the emerging economies' slowdown in 2015–but it will also benefit less from their expected rebound in 2016. The overall scenario is thus a moderate acceleration in 2016 and a stronger one in 2017, sustained by the expected growth in trade inside the euro area.

The gains from the past decline in oil prices and the favourable exchange rate could be invested or consumed faster than expected in the advanced economies, thus quickening growth. By contrast, the slowdown in Chinese demand due to excess manufacturing capacity and the economy's shift towards consumption and services could be stronger than forecast, but would likely entail a more robust effort by Chinese authorities to support demand. Lastly, commodity prices–particularly oil prices–and exchange rates are subject to many contingencies. Depending on the circumstances, they may therefore stimulate or constrain economic activity in the advanced and emerging countries. Overall, the uncertainties affecting this scenario are evenly balanced.